Citing a tale from the Talmud in which the rabbis tell God, “You gave us a document to interpret and a methodology for interpreting it. Now leave us to do our job,” (Harvard Law Professor Alan) Dershowitz sees a lesson for Americans.

“The Letter and the Law”, Washington Post, Feb. 7, 2008

Woe to you lawyers! For you have taken away the key of knowledge. You did not enter yourselves, and you hindered those who were entering.

Jesus of Nazareth, Luke 11:52

Why do the nations rage[a]

and the peoples plot in vain?

The kings of the earth set themselves,

and the rulers take counsel together,

against the Lord and against his Anointed, saying,

“Let us burst their bonds apart

and cast away their cords from us.”

He who sits in the heavens laughs;

the Lord holds them in derision.

“The Finger of God”, Carina Nebula

My mother has long enjoyed telling tales of my childhood exploits. This is one of the few that has never embarrassed me.

On the contrary, its retelling tends only to stir again a certain mischievous joy in that inner “naughty little boy” who, at age 32, succumbed to friendly pressure to go on a “just for coffee” blind date with an evangelical Christian lassie rumoured to be highly attractive and rather zealous, and so turned up in a T-shirt boldly proclaiming SATAN MADE ME DO IT out of curiosity to observe her reaction.

You see, when I was a wee lad, my parents were, for a time, members of one of the countless derivative sects of protestant Christianity. As with many others birthed in the Anglosphere in the 18th-20th centuries, this sect had its own founding “prophet”, who laid down a library of stringent rules for all aspects of one’s life conduct. A failure to observe any of these innumerable earthly rules risked the threat of Eternal Damnation, of not being counted among The Chosen in the Book of Life, and so not destined for heaven.

One of its most important rules derived from the biblical command of ‘God’ to pay the ancient Hebrew priest caste the church hierarchy a ‘tithe’ tax not less than 10% of my father’s before tax income.

Quelle surprise.

One day, while still in kindergarten, this naughty little boy made a wonderful discovery. Right there, in the Holy Bible, was the parentally-forbidden word “piss”:

And it came to pass, when he began to reign, as soon as he sat on his throne, that he slew all the house of Baasha: he left him not one that pisseth against a wall, neither of his kinsfolks, nor of his friends.

Gesenius’ Hebrew-Chaldee Lexicon (“shâthan” – make water, urinate)

Indeed, it turned out that this naughty word appeared in King James’ Version of the Holy Word of God on no less than 6 occasions. As you can imagine, I was beside myself with glee.

“Pisseth pisseth pisseth pisseth pisseth pisseth pisseth!”

“Dad, may I be excused please? I need to go and pisseth.”

“I’m sorry (for not coming promptly when called) Mum. I was busting to pisseth.”

My ‘holy’ enthusiasm soon posed a growing threat not only to family discipline and decorum but also to the very fabric of order and piety in the wider church society. For naturally, I was zealously sharing the supporting proof of my licence to sin with all the other children.

At a loss to come up with a more persuasive argument against my giving voice, loudly and often, to the literal Word of God, my parents were left to fall back on a plaintive “that word is from olden times; it’s not nice to say it now” as their primary tool of discouragement until the novelty of horrifying the adults in the room wore off.

Curiously, by the time I reached high school, to casually pronounce that one needed to go and “urinate” or “defecate” provoked a similar response from authority figures, despite these also being the technically “correct” and “proper” words, as I took no small delight in pointing out.

Unlike yours truly at age 5, the rabbinic sages of ancient Rome were able to come up with far more sophistic-ated arguments for sin. Their legal debates and decisions on property and usury laws exhibit telling correspondences with the ‘modern’ banking system, and with the key words and definitions used in financial accounting.

Thanks in large part to more than a century of Western education and cinema indoctrinating multiple generations with a blind faith in a theory of nature’s, and thus, humanity’s, innate tendency to evolve (“progress”), from “simplicity,” “ignorance” and “superstition,” supposedly moving, inexorably, towards an ultimate, “advanced” state of “sophisticated” utopian apotheosis, and so encouraging us to place our hopes for the future in technology sans morality enabling Self-Deification (immortality), we tend to assume that, compared with ours, the great civilisations of past æons must have been quite “backward”. Like most things we have been led to believe, closer examination reveals that, in many respects, this is entirely false. While in other respects, it becomes increasingly apparent that the deification of “sophistication,” and the scorning of “simplicity,” is not necessarily wise.

The circa 1000-year ecclesiastic prohibition of usury in late-Roman through late-Renaissance Europe and Britannia has been widely portrayed as being the result of “medieval” Christian superstition. Rarely mentioned is the Roman Republic’s Lex Genucia reforms (342 BC) banning money-lending at interest, almost four centuries before Christianity was birthed. This is not to imply that the Romans succeeded in their attempts to regulate financial “sophistication”. History records a rather more nuanced, and enlightening picture. One must simply understand where, and how, to go digging for it.

During the Principate era (c. 27 BC to 284 AD) of the Early Roman Empire, banking was conducted mostly by private individuals and firms functioning very much like large banks today. As the Empire expanded, vast numbers of slaves and skilled artisans were both compelled and enticed to settle in Rome and near provinces, and in its key industrial and trading centres abroad:

It is very clear from all sources that debt existed and that money was loaned out. In fact, money-lending was perceived as the second most important form of ‘investment’ after land. As such, on average, if no land was available, or if it was not a good investment, the Romans would try to lend their money. This was a big business and it was conducted by all strata within the economy.

It was not only the rich who loaned their money: credit was bountiful and wide-ranging, and this was “indicated by the variety of sources for loans and the sophistication of their forms. Depending upon the client and his needs, credit could be obtained from aristocratic financiers, from the publicani [corporations], from entrepreneurs, from the state (at least in Egypt), from civic treasuries, from temple funds, from foundations, from bankers, from money-lending partnerships, from loan clubs, from pawn-brokers, from loan sharks, and from other individuals who might lend occasionally. Money-lending was sufficiently widespread for it to be a requirement to declare money out on loan in the census. In addition to advances of money, credit was to be had in shops. In the finance of overseas trade maritime credit continued to play its part alongside mutual associations (societates). Money loans or arrears are attested in rural areas in Italy and in some provinces. Rural debt in money, as well as in kind, was surely ubiquitous.” Furthermore, this readily infers that money-lending was also available to all strata of the Empire, which can also be measured by the extent of “the social advancement of some professional bankers. The bankers, who were predominantly freedmen, were able to purchase property from their earnings. Some reached the highest honours normally available to freedmen other than the richest of imperial secretaries. This was possible despite the fact that for the most purposes bankers were not used by the elite, whose requirements ran beyond the means of individual bankers, and who relied upon their social peers when in need. The betterment of professional bankers was thus in part a reflection of the use of credit by the likes of wholesale merchants, artisans, shopkeepers, and property owners below the elite.”

Temin wrote: “The surprising result is that financial institutions in the early Roman Empire were better than those of 18th century France and not too far from those of the 18th century England and Holland.” Once again, the sheer magnitude and sophistication of the Roman Empire is brought to the forefront: in essence, this underlines the fact that it took the Western world at least 1,500 years to reach similar levels of sophistication in the field of financial intermediation…[1]

The legal debates of the rabbinic sages that we will examine in what must be a multi-part essay are of particular interest when seen in light of their historical context: the destruction of the Jerusalem Temple (c. 70 AD), the extensive depopulation of Judea (c. 136 AD), the Crises of the Third Century (235–284 AD), the decline and fall of the Roman Empire, the rise of Christianity (eventually becoming the state religion in 380 AD), and changes in what might, or, might not, depending on one’s motives, be honestly interpreted as “the laws of the gentiles,” at specific times and places, with regard to the practice of usury.

The Bava Metzia (“Middle Gate”) is a Babylonian Talmud tractate dealing with Nezikin (The Order of Damages). The Jewish Encyclopedia explains:

It treats of man’s responsibility with regard to the property of his fellow-man that has come lawfully into his possession for the present, and of which he is considered as trustee. The tractate is based on Ex. xxii. 6-14 (A. V. 7-15). In this passage four kinds of trustees are distinguished: (a) One who keeps the thing entrusted to him without remuneration (verses 6-8); (b) one who is paid for keeping the trust (verses 9-12); (c) one who keeps a thing entrusted to him for a certain time for his own use without paying for its use (verses 13, 14a); and (d) a trustee who keeps a thing for his own use and pays for using it (14b).

Before we penetrate the “Middle Gate”, it is a most enlightening exercise in mental gymnastics, viz. creative assumptions (b) and tortured definitions (“fellow-man”), merely to attempt a logical comparison of the above definitions with the plain meaning, implication, and spirit of the words actually written in the Torah (Old Testament Pentateuch) at Exodus 22:6-14 (cf. 7-15 CJB transl.).

Try. I’ll wait….

For readers who may be unfamiliar, a little historical background is necessary before we move on, so that we may better understand the context, and chronology.

Ever since the destruction of the Temple at Jerusalem in the Great Revolt – the First Jewish-Roman War (66–73 AD) – it has not been possible to perform the primitive agricultural society cult ritual of animal (blood) sacrifices for “cleansing” of sins. A truly epochal tragedy, for which wailing, gnashing of teeth, liturgical prayers, “Next year in Jerusalem” mantras, and for some, plotting and scheming, have continued for two thousand years. A world of “progress” toward hell ever since. And we, the goyim (Gentiles) – especially the “Romans” – are entirely to blame. For everything. All the evils of the world, are our fault alone.

Do not take my word for it though. Witness the central text of Jewish theosophy (mysticism) – on which we will have much more to elaborate at a later date – and, the holy founder of one of the largest, most influential Lurianic-Cabalist sects in the world; those nice, humble and harmless, mono-suited Men-in-Black hats often seen standing in large groups around the desks of presidents:

SAID Rabbi Abba: “‘Nephesh hahaya’ (living soul) truly denote the souls of Israel. They are the children of the Holy One and holy in his sight, but the souls of the heathen and idolatrous nations whence come they?” Said Rabbi Eleazar: “They emanate from the left side of the sephirotic tree of life, which is the side of impurity, and therefore they defile all that come into contact with them.[2]

Zohar (זֹהַר , lit. “Splendor” or “Radiance”), 13th century A.D.

Gentile souls are of a completely different and inferior order. They are totally evil, with no redeeming qualities whatsoever… Their material abundance derives from supernal refuse. Indeed, they themselves derive from refuse, which is why they are more numerous than the Jews… [3]

Rabbi Schneur Zalman (1745–1812), Chabad-Lubavitch

Why such seething hatred in the hearts of the rabbis?

Why such a hate-filled, Other- and Self-destructive, extremist, supremacist, racist, fundamentalist ideology, embedded in a “sexualised, divine” ‘magic’ theosophy?

You see, no longer could a Jew commit a sin against God, or against a fellow Jew – like, say, getting your period, or having a wet dream – go wait in a queue to buy an unblemished cow or sheep or pair of pigeons or turtle-doves from the temple thieves (after first getting raped at the currency exchange by the temple banksters), hand the poor doomed creature/s over to the pious, habitually de-sensitised, blood-thirsty rabbis dressed in tunics, pants, ephods (aprons), turbans and robes made from pure gold-threaded 6-ply “twisted” linens dyed with hillazon (“rare” and “expensive”) tekhelet (blue), scarlet, and Tyrian “Royal” Purple – even more rarified, a colour subject to Roman sumptuariæ lex restrictions since the Lex Oppia in 215 BC[4], whose dye the insanely profligate Nero (37-68 AD), said to have never worn his garments twice and to have fished with a gold net drawn by cords woven of purple and scarlet threads[5], confiscated Empire-wide[6] – a double-dipped (“dibapha”) linen which the contemporary Roman historian Pliny wrote (77-79 AD) “could not be bought for even one thousand denarii per pound[7],” more than its weight in gold, and “considered of the best quality when it has exactly the colour of clotted blood, and is of a blackish hue to the sight, but of a shining appearance when held up to the light; hence it is that we find Homer speaking of ‘purple blood'”[8]; a “blood” harvested from ‘unclean’, predatory sea-snails, resulting in Royal linen stinking to high heaven and needing to be aired out for weeks before use, driving a vast luxury perfume industry[9] to conceal the overwhelmingly fishy stench, and prompting Pliny to wonder how something smelling so bad (virus grave in fuco) could be so highly valued[10]; which “intrinsically holy” garments were not allowed to be washed, and so, on becoming “soiled” in the course of massive ritual blood-letting were shredded and used as candle wicks (hey, at least the Jewish priests maximised the utility of their bloody rags, right?), said priests waiting to slit your creature’s throat, butcher and holocaust it for you on their altar; then toddle off home, mindful not to step in the literal rivers of blood flowing from the Temple slaughtering area via “blood channels” designed by the Great Architect of the Universe, washed away by “sweet”[11] water from the Gihon Spring (מעיין הגיחון, Fountain of the Virgin) of Siloam (“Shiloh”, built on Zoheleth [זֹחֶלֶת “crawling thing”; Arabic زحل Zuhal: Saturn] the “Serpent Stone”, where king David’s son Adonijah held a great feast in an attempt to usurp the throne from his brother Solomon; from whence the occultist sex ‘magic’ Sleep of Siloam), with a clear conscience that ‘God’ had now forgiven you for blood flowing from your fertile ▽, or for waking up in a wet spot.

We will come back to all that, gentle reader. On other days. God willing. It will take us quite some time to work through it all. Today is mere introduction.

The Talmud is a voluminous collection of writings with two main components: the Mishnah (c. 200 AD), a written compilation of the Oral Torah, that is, the “Oral Traditions” (lore) of the rabbinic sages up to c. 200 AD; and the Gemara (c. 500 AD), a compilation of rabbinical analysis (i.e., dialectical debate) and commentary on the Mishnah. The Gemara has two versions – the Babylonian and Jerusalem Talmuds – each compiled in their respective geographic centres of rabbinic study. Of these, the Babylonian Talmud is considerably the larger, comprising some 1.8 million words.[12] The three centuries in between the Mishnah and Gemara, coinciding with the decline and fall of the Roman Empire, are known as the age of Amora’im (“those who say”, “those who speak over the people”).

During these three centuries the great rabbis, principally centred in Babylonia (in modern Iraq) and connected via trading routes with the Jewish communities throughout the Roman diaspora, permanently transferred the benchmark of Jewish religious and legal culture away from the Torah (Pentateuch of Old Testament), to a new one establishing the authority of the rabbinate.

Supreme Authority, that is.

Even over God Himself.

In the great Talmudic tale referred to by Alan Dershowitz of a fantastical and puerile legal debate between ‘sages’ over the religious purity status of an earthenware oven divided into segments with sand – the crux of which argument hinged on whether it is classified as a “complete” oven (cf. cooking the books: “For every credit there must be a debit, and for every debit there must be a credit.” – Voila! A “complete” ‘oven’) – the chief protagonist is claimed to have invoked a series of miracles, as proof that God was witnessing that his position was correct. All to no avail. Even when God Himself spoke from Heaven in support, the other rabbis still conjured up excuses to defy the argument presented. In the conclusion we learn from a new tale – a conversation between a rabbi and the divine fiery chariot-driving immortal Jewish prophet who just happens to possess the same magic powers as the alchemists’ god Hermes, to cross back and forth over divine boundaries at will – that even God has accepted that He cannot defeat the ‘sages’ in a legal argument.

Why?

Apparently the All-Wise, All-Knowing Creator of the Universe cannot defeat the logical fallacy argumentum ad populum (“if many believe so, it is so”; the “appeal to the majority”):

Rabbi Eliezer then said to them: If the halakha [religious law] is in accordance with my opinion, Heaven will prove it. A Divine Voice emerged from Heaven and said: Why are you differing with Rabbi Eliezer, as the halakha is in accordance with his opinion in every place that he expresses an opinion?

Rabbi Yehoshua stood on his feet and said: It is written: “It is not in heaven” (Deuteronomy 30:12). The Gemara asks: What is the relevance of the phrase “It is not in heaven” in this context? Rabbi Yirmeya says: Since the Torah was already given at Mount Sinai, we do not regard a Divine Voice, as You already wrote at Mount Sinai, in the Torah: “After a majority to incline” (Exodus 23:2). Since the majority of Rabbis disagreed with Rabbi Eliezer’s opinion, the halakha is not ruled in accordance with his opinion. The Gemara relates: Years after, Rabbi Natan encountered Elijah the prophet and said to him: What did the Holy One, Blessed be He, do at that time, when Rabbi Yehoshua issued his declaration? Elijah said to him: The Holy One, Blessed be He, smiled and said: My children have triumphed over Me; My children have triumphed over Me.[13]

Rabbi Yirmeya’s circumcised ‘quote’ from Exodus 23:2, used as a rational-isation for the ‘triumph’ of a logical fallacy, and a rabbinic fairy tale of their victory over God – a defeat by His sons – is not what the verse actually says. It is an arrogant, circular, self-justifying inference, drawn from a category error. For the insightful, a very revealing one. As we will discover, it has had profound consequences for all of humanity, and Mother nature, ever since:

Do not follow the crowd when it does what is wrong; and don’t allow the popular view to sway you into offering testimony for any cause if the effect will be to pervert justice.

Thou shalt not follow a multitude to do evil; neither shalt thou speak in a riv (cause, lawsuit) to turn aside after many to pervert justice; …

Now at first glance, you may think that Rabbi Yirmeya’s inference is quite reasonable: that the exact opposite side of the coin “Do not follow the crowd to do evil” is “Do follow the crowd to do good”; that this is really the same thing. You may then be tempted to think that the only logical error – and in context of the circumstances, one we might reasonably ignore – is the “appeal to the majority” made by … the Rabbi Yehoshua-supporting majority!

After all, that’s democratic. A con-sensus of opinion. And a democratic majority view must always be right … right?

Wrong.

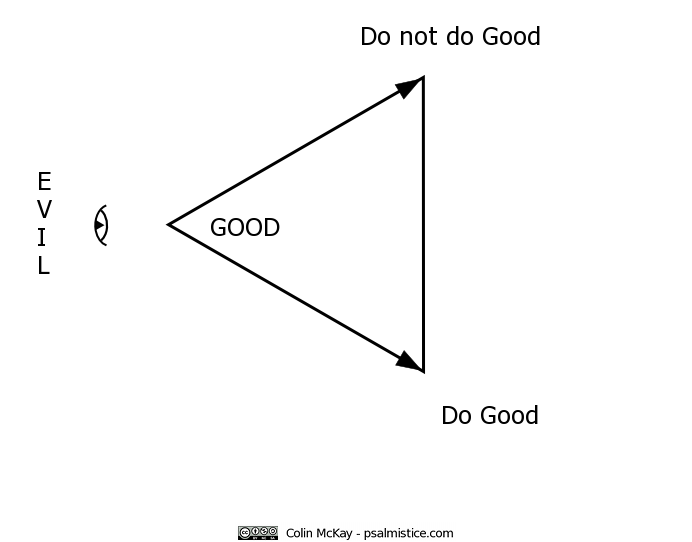

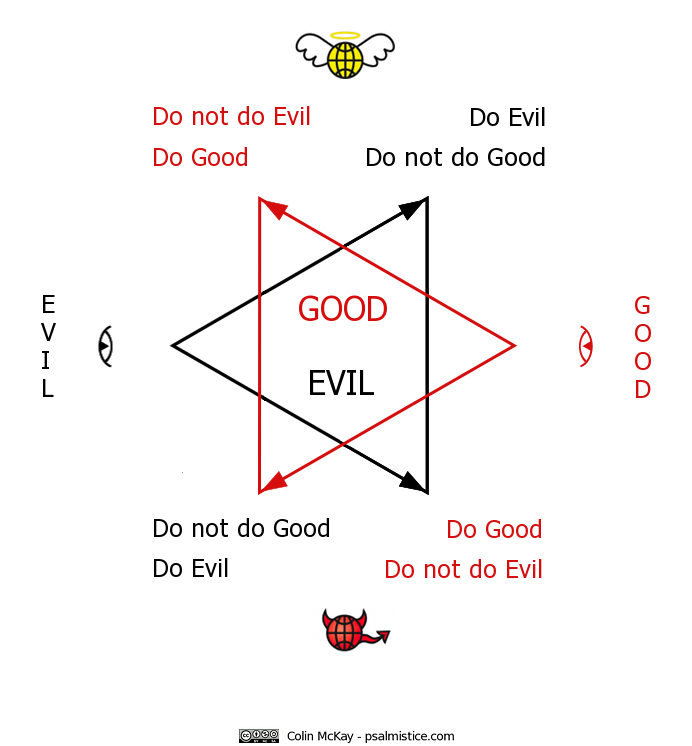

Good and Evil are not relative concepts. They are not subject to opinion. They are not subject to “majority rules”.

Good and Evil are objective realities. Two distinct, opposite categories.

To choose, or to act, are also objective realities. To “do” and “not do” – i.e., to hold back from doing – are two distinct, opposite categories.

In the case of objective Good, a good person will view “Do Good” as the highest choice, and “Do not do Good” (i.e., do nothing; hold back, refrain from doing Good) as the lowest choice:

An evil person will view the same category (objective Good) in the exact opposite way: to “Do Good” is the lowest choice, and “Do not do Good” (i.e., do nothing; hold back, refrain from doing Good) is the highest choice:

The complete spectrum for doing or not doing objective Good thus looks like this:

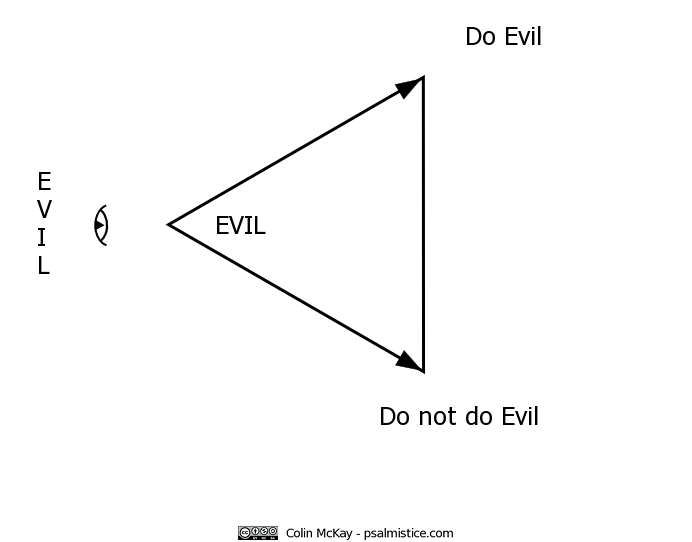

When it comes to the separate, distinct category of objective Evil, a good person will view “Do not do Evil” (hold back, refrain) as the highest choice, and “Do Evil” as the lowest choice:

An evil person will view the same category (objective Evil) in the opposite way: to “Do Evil” is the highest choice, and “Do not do Evil” is the lowest choice”:

The complete spectrum for doing or not doing objective Evil thus looks like this:

If we mix together the two opposite choices (“Do” or “Do not do”) with respect to the two opposite, objective categories (Good or Evil), the complete spectrum looks like this:

Doing the right thing – objective Good – requires daily sacrifice. Of our Ego, mostly.

And do–ing that can be “bloody” painful at times, right?

So you see, the ‘triumphant’ rabbinic majority’s argument, that God Himself supposedly could not defeat, really amounts to an error of perspective. On Self. Blindness to the true state of one’s own Being.

The result is a mixing together of opposites – the objective realities of Good and Evil, and, of “Do” and “Do not do”.

- We are right. (arrogance, Ego-blinded presumption)

- “Do not follow the crowd when it does what is wrong” implies the same thing as “Do follow the crowd when it does what is right.” (category error; obfuscating reality of objective opposites)

- We are the crowd. (i.e., majority)

- Ergo, we are right. (“appeal to the majority”; our Selves!)

God is dead. Might is right.

Though unafraid of straying from his ostensible topic, Dershowitz never wanders far from his favorite subject: himself.

Rabbi Abba ben Joseph bar Ḥama (c. 280 – 352 AD), exclusively referred to in the Talmud as Rava (רבא), is a fourth-generation amora who lived in Maḥoza, a suburb with large Jewish and Christian communities on the west bank of the River Tigris, just across the river from Ctesiphon in Babylonia, the capital and “intellectual and religious center of the Persian Empire”:

The Sassanian Empire [224 – 651 AD] was a meeting point of religions and cultures. Although the official religion of the ruling dynasty was Zoroastrianism, Judaeo-Christian sects and Semitic pagan cults jostled with each other in splendid confusion in Mesopotamia. To these was added a strong Jewish presence in Babylonia and Adiabene… [S]yncretism was the order of the day, with Judaeo-Christian sects like the Elchasaites (among whom the prophet of Manichaeism, Mani, was raised), Christian sects such as the Marcionites, and certainly the Manichaeans and Mandaeans, all competing for converts. In some parts of the Empire, especially in the east, Buddhism was a factor.[14]

These sects did not exist in peaceful isolation. Some were at various times persecuted severely, especially the more orthodox Christian sects that were looked upon as natural allies of the Roman enemy. In 339, the catholicos, Simeon bar Sabbae, was martyred under Shapur II. A century earlier, the self-styled prophet, Māni, wore out his welcome at the court of Shapur I, and died in prison martyred by Vahram I (273-276). Mani’s influence continued to grow, however, including among the acculturated Jewish community of Maḥoza.

Maḥozans were wealthy, cosmopolitan, canny, and skeptical of rabbinic authority. Even members of the household of rabbinic authorities were not greatly informed about the intricacies of everyday halakhah [religious law]. Maḥozans had the reputation of being perspicacious and delicate, the women were pampered and idle, the men pursued still more wealth and the good life.

We can say this: the Babylonian Talmud was not produced in a ghetto, nor was it initially studied and transmitted in one. Its major figures, experts in Jewish traditions, were also very aware of broader currents in the general culture.[15]

Rava is one of the most often-cited rabbis, “the commanding local presence in the Babylonian Talmud, who is mentioned some 3800 times in the text.” His methodology for dialectical debate is said to have greatly influenced the stammaim (“redactors”), whose work “constitutes just over half of the total text of the Babylonian Talmud and which frames the discussion of the rest.”[16]

Out of hundreds of recorded disputes between Rava and his study partner Abaye (“Little Father”), “the law is decided according to the opinion of Abba ben Joseph in all but six cases.”[17] His yeshiva became one of the intellectual centres for the Babylonian Jewish community.[18]

Rava’s creativity was fueled by his cosmopolitan urban environment. For instance, he ruled that one who habitually ate certain non-kosher foods because he liked the taste was nevertheless trustworthy as a witness in cases involving civil matters. So too did he suggest that a lost object belongs to the person who discovers it even before the loser is aware of his loss, because it prevented the loser from resorting to urban courts to try to get his property back and eliminated the period of uncertainty of possession. It also led to the legal concept that “future [psychological] abandonment [of possession] when unaware [of the loss] is [nevertheless retrospectively accounted] as abandonment.”[19]

A truly ‘creative’ Lord of Time.

Remarkably, this great ‘sage’ informs us that the very same All-Wise, All-Knowing God, who supposedly could not distinguish between the rabbis fallacious mixing together of Good and Evil and “Do” and “Do not do” in the great debate over the purity of a “complete” oven, apparently can tell the difference between the drops of semen that distinguish a firstborn child from later children in the households of the ‘evil’ goyim (Gentiles):

Rava explains: The Holy One, Blessed be He, said: I am He Who distinguished in Egypt between the drop of seed that became a firstborn and the drop of seed that did not become a firstborn, and I killed only the firstborn. I am also He Who is destined to exact punishment from one who attributes ownership of his money to a gentile and thereby lends it to a Jew with interest. Even if he is successful in deceiving the court, God knows the truth. And I am also He Who is destined to exact punishment from one who buries his weights in salt, as this changes their weight in a manner not visible to the eye. And I am also He Who is destined to exact punishment from one who hangs ritual fringes dyed with indigo [kala ilan] dye on his garment and says it is dyed with the sky-blue dye required in ritual fringes. The allusion to God’s ability to distinguish between two apparently like entities is why the exodus is mentioned in all of these contexts.[20]

Mixing together the money of the Evil with the money of the Good, in order to lend at usury to the Good, is Evil.

Cheating the Good, by invisibly altering your weights used for counting money and goods by weight, is Evil.

Using inexpensive vegetable dye to perfectly imitate a colour that “YHVH”, via the exclusively-privileged intermediation of Good elite rabbis, has declared to be compulsory for the common Good to wear on their compulsory fringes, and that must only be coloured using a rare, phenomenally expensive, Imperial Roman elite-restricted, magical light-transformed dye (6,6′-dibromoindigo), produced using secret gnōsis (“knowledge”), from the Good “old wine”, “clotted blood”-like secretions of Evil (“unclean”), non-kosher, human female genitalia-analogous, bottom-dwelling, predatory and cannibalistic sea creatures, by an independent city-state global maritime empire of Evil pagans… is Evil.

What is the letter Vav?

He said: There is an upper Heh [5] and a lower Heh [5].*

They said to him: But what is Vav [6]?

He said: The world was sealed with six directions.

They said: Is not Vav a single letter?

He replied: It is written (Psalm 104:2),

“He wraps Himself in light as a garment,

(he spreads out the heavens like a curtain).”

Sefer ha-Bahir (“Book of Illumination”), c. 1176 AD[21]

* Vav ו (“hook,” “peg,” or “spear,” that “binds” heaven and earth;

the phallus; value: 6).

Heh ה (the Soul; five fingers of magic hamsa hand; “Hashem,”

a Name for God; female “cup” / ‘upper’ and ‘lower’ “waters”;

thought, speech & action; value: 5)

Good rabbinic authorities engaging this maritime empire city-state for 192 years as their “independent” central bank, issuing High-Powered Money (HPM) for the Second Temple blood ritual cult – a silver shekel expressly re-designed to bear the image of an Evil pagan god of sea*-dominating commerce and a dedication to his “holy city” of safe space (“refuge”) – to ensure that the “full value”[22] of the Temple cult’s accumulated assets (e.g., “Gold sheets to cover the Holy of Holies”), and annual wealth-extraction, both kept pace with inflation; using this HPM mechanism to rape the common Good with punitive, unjust exchange rates on “ransom for your life so “YHVH” doesn’t smite you with a plague” annual Temple taxes, payable only in Evil-‘transformed’-into-Good pagan silver shekels; enabled by a well-‘oiled’ system of insidious national propaganda based on the “scapegoat”[23] festivals of Evil Babylon (Sakaia) and Evil Rome (Saturnalia); unsubtly threatening the common Good population with involuntary seizure (“mortgage”) of assets if they do not pay up, every year, on the very morning after inciting them to drink until they “cannot tell the difference between” Good and Evil, while conjuring up legal exemptions for the Good priest class, all ‘divinely’ ‘justified’ by casuistries and pious sophistry… is Good.

(* “sea” – ancient esoteric pun, associating ‘waters’ of mother earth with Evil; primordial chaos, the female)

Bribing the disciple of an Evil Galilean activist who challenged the laws created by the Good elite rabbis to circumvent the Written Law commanding 7th-year debt cancellations – offering him a bounty of thirty (30) ‘holy’ safe space pagan city-state-issued silver shekels to betray his Evil master – and having him tried and crucified as a criminal for challenging the perpetual debt servitude-enabling Oral Laws (“traditions) of the Good elite rabbis… is Good.

But wait!

Apparently this very same All-Wise, All-Knowing God, the one Who is “destined to exact punishment from” the Good (or is that Evil?) for cheating the Good – because even if the Good (Evil?) cheat can deceive a rabbinic court, he cannot deceive God, because the Good God knows the truth, and can even tell the difference between the drops of semen that distinguish a firstborn child from later children in the households of the ‘Evil’ goyim (Gentiles) – well, at exactly the same time, on His exact opposite hand, apparently this very same All-Wise, All-Knowing God can not tell the difference between the drops of semen that distinguish a firstborn child from later children in the households of the Chosen Ones, the ‘Good’ Israelites.

How so?

Because, as we are told in the Torah, the Israelites had to slaughter an innocent lamb .. or, a baby goat .. and paint their doorposts with the lamb’s or kid’s blood, so that their All-Wise, All-Knowing ‘God’ could see which households to smite (Egyptian) and which households to Pass over (Israelite):

Your animal must be without defect, a male in its first year, and you may choose it from either the sheep or the goats.

For that night, I will pass through the land of Egypt and kill all the firstborn in the land of Egypt, both men and animals; and I will execute judgment against all the gods of Egypt; I am Adonai. The blood will serve you as a sign marking the houses where you are; when I see the blood, I will pass over you…

Exodus 12:5, 12-13, Complete Jewish Bible

The Torah also informs us that from the largely, if not entirely imaginary (as we will discover) moment in time out in the Egyptian desert, when ‘Moses’ (allegedly) received The Law from God, twice, ‘God’ demanded a twice-daily, sunrise-sunset, dawn-and-dusk (Inanna-Ishtar-Virgin/Whore-Love/War-Lucifer-Venus morning-and-evening ‘star’), slaughter and holocaust of innocent lambs – but not goats – “forever” (תָּמִיד tâmîyd : “standing”, perpetual, from root “to stretch”). A primitive cult ritual practice ruined by the ‘evil’ Romans when, in response to a Jewish armed revolt against paying Roman taxes, the Roman army destroyed their Temple at Jerusalem, some 40 years after one Jesus of Nazareth tried to inspire a People’s revolt against the binding, usurious debt obligations legally-enabled by, and the payment of “ransom” taxes to, the rabbis’ Jerusalem-based Temple cult.

If you are gullible enough to believe the reams of ‘dialectical’ anal-ysis and “commentary” written by 3rd-5th century A.D. now-in-forced-exile from Eretz Yisra’el – again – wealthy cosmopolitan Maḥoza-resident Babylonian rabbis, retrospectively professing that their now-defunct Second Temple priest caste ancestors were not personally benefitting from what we will discover was an outrageous, mobster-esque, blood-thirsty extortion racket imposed on their own people, one marked by disturbing similarities to our present-day systems of governance, jurisprudence and finance, then do I have a Santa Claus / Father Frost story and a mountain of minutely-detailed (pun intended) evidence for you.

“When the Son of Man comes in his glory, and all the angels with him, then he will sit on his glorious throne. 32 Before him will be gathered all the nations, and he will separate people one from another as a shepherd separates the sheep from the goats. 33 And he will place the sheep on his right, but the goats on the left.

34 Then the King will say to those on his right, ‘Come, you who are blessed by my Father, inherit the kingdom prepared for you from the foundation of the world. 35 For I was hungry and you gave me food, I was thirsty and you gave me drink, I was a stranger and you welcomed me, 36 I was naked and you clothed me, I was sick and you visited me, I was in prison and you came to me.’ 37 Then the righteous will answer him, saying, ‘Lord, when did we see you hungry and feed you, or thirsty and give you drink? 38 And when did we see you a stranger and welcome you, or naked and clothe you? 39 And when did we see you sick or in prison and visit you?’ 40 And the King will answer them, ‘Truly, I say to you, as you did it to one of the least of these my brothers,[a] you did it to me.’

41 “Then he will say to those on his left, ‘Depart from me, you cursed, into the eternal fire prepared for the devil and his angels. 42 For I was hungry and you gave me no food, I was thirsty and you gave me no drink, 43 I was a stranger and you did not welcome me, naked and you did not clothe me, sick and in prison and you did not visit me.’ 44 Then they also will answer, saying, ‘Lord, when did we see you hungry or thirsty or a stranger or naked or sick or in prison, and did not minister to you?’ 45 Then he will answer them, saying, ‘Truly, I say to you, as you did not do it to one of the least of these, you did not do it to me.’ 46 And these will go away into eternal punishment, but the righteous into eternal life.”

Jesus of Nazareth (Matthew 25:31-46)

A few words on this inspirational message, with regard to virtue-signalling hypocrites; also, those wearing bleeding hearts on sleeves, and/or, any of the well-meaning yet dangerously gullible who may be reading. Do not fall into the pilpul-wielders’ trap, cherry-picking Jesus’ message out of context, and using it as ‘divine’ licence, or endorsement, for acts of abject stupidity. Such as, visiting an island of known murderous savages, in spite of all warnings, and its being illegal to visit this island, to preach “the good news”; and going back again, the day after they greeted your first “loving” attempt to intrude on their community, with a hail of arrows. Or, welcoming hundreds of thousands of military-age men from cultures having entirely different values with respect to (eg) “expressing” physical violence against the physical person of others, just because your government, media, ‘celebrities,’ similarly-brainwashed religious leaders, and “the majority” of TV-entranced, logos-bereft, brain-on-autopilot gibbering fools all around you are preaching that “It’s the right thing” to do. They are wrong. Worse, many of them are not merely wrong. They are brazenly, malevolently lying. Jesus was teaching his followers – mostly common Jews; hungry, poor, sick, homeless, oppressed, financially raped and pillaged by their own legal authorities, the rabbis – to love and support each other. On the basis of correct context, and, in consideration of other statements attributed to him – such as, an initial refusal to have anything to do with a .. wait for it .. Syro-Phœnician woman, in the region of Tyre(!), asking for his help with her demonically-possessed child (this is seriously significant stuff, gentle reader; you have no idea, but will, in future essays) – my personal opinion is that Jesus would not have told his followers, especially the females and effeminates, to rock on down to the train station or the docks at Haifa to welcome with open arms, legs, and flowers, an Open Society-financed, rabbinically-endorsed invasion of doubtless lovely and genuinely desperate refugees from rabbinically-endorsed regime change wars abroad, blended with (say) Mongols, Hutu or Tutsi, or Bolshevist, Khmer Rouge, or ISIS-inspired, New York and London bank-financed, ne’er-do-well psychopaths from far-flung parts of the known world.

In other words, do not be like the rabbis. Do not slice-and-dice out of context, and twist a small piece of “the good news” to make it serve as ‘divine’ licence for elite interests, under the “I am such a good person, see? Look! Look at me!” blind guise of “love your neighbour kin-folk”.

A wholehearted, religious acceptance of both sides in logical “paradoxes”, irreconcilable contradictions, exact opposites, as being equal, and equally true, poses no intellectual, spiritual, or moral difficulty for Jewish law, philosophy, theosophy, and culture. Beginning in Genesis – even earlier than the Exodus tale, the foundation for halakha – this ‘Orwellian’ doublethink is embedded as the heart, mind, and soul of Judaism:

The Talmud strictly forbids a Jew, on pain of severe punishment, to take interest on a loan made to another Jew. (According to a majority of talmudic authorities, it is a religious duty to take as much interest as possible on a loan made to a Gentile.) Very detailed rules forbid even the most far-fetched forms in which a Jewish lender might benefit from a Jewish debtor.[24]

The vain cultivated the color purple.

The vain cultivated the color purple.

He had precious notions about life, but was

often more cultured than humane.[25]

Since the time of the late Roman Empire, Jewish communities had considerable legal powers over their members. Not only powers which arise through voluntary mobilization of social pressure (for example refusal to have any dealing whatsoever with an excommunicated Jew or even to bury his body), but a power of naked coercion: to flog, to imprison, to expel—all this could be inflicted quite legally on an individual Jew by the rabbinical courts for all kinds of offenses. In many countries—Spain and Poland are notable examples—even capital punishment could be and was inflicted, sometimes using particularly cruel methods such as flogging to death.[26]

There is a significant volume of scholarly work, most notably that of Israeli academics, evidencing the same trend towards rabbinic theocracy recurring in the purportedly secular-democratic modern Israeli state since the 1982 Lebanon War, especially in terms of growing influence on both military and “settler” ‘ethics’.

David Shasha, director of the Center for Sephardic Heritage warns:

For those who have any concern with the Middle East conflict or with Judaism, what you know — or do not know — about pilpul is something upon which your well-being could depend. Ignorance of pilpul is a very dangerous thing, something that would allow your interlocutor to have the upper hand in ways that you could not begin to even imagine.

Pilpul is the Talmudic term used to describe a rhetorical process that the Sages used to formulate their legal decisions. The word is used as a verb: one engages in the process of pilpul in order to formulate a legal point. It marks the process of understanding legal ideas, texts, and interpretations. It is a catch-all term that in English is translated as “Casuistry.”

What this means for contemporary Jewish discourse is critical: Even though many contemporary Jews are not [religious] observant, pilpul continues to be deployed. Pilpul occurs any time the speaker is committed to “prove” his point regardless of the evidence in front of him. The casuistic aspect of this hair-splitting leads to a labyrinthine form of argument where the speaker blows enough rhetorical smoke to make his interlocutor submit.

In this context, the Law is not primary; it is the status of the jurist. Justice is extra-legal, thus denying social equality under the rubric of a horizontal system. Law is in the hands of the privileged rather than the mass.

What is thought to be the Jewish “genius” is often a mark of how pilpul is deployed. The rhetorical tricks of pilpul make true rational discussion impossible; any “discussion” is about trying to “prove” a point that has already been established. There is little use trying to argue in this context, because any points being made will be twisted and turned to validate the already-fixed position.

Pilpul is the rhetorical means to mark as “true” that which cannot ever be disputed by rational means.[27]

Remember Rabbi Eliezer, on whose behalf even God Himself, performing miracles and speaking from Heaven, was unable to defeat the doublethink and logical fallacy endorsed by the majority?

The Sages said: On that day, the Sages brought all the ritually pure items deemed pure by the ruling of Rabbi Eliezer with regard to the oven and burned them in fire, and the Sages reached a consensus in his regard and ostracized him.

And the Sages said: Who will go and inform him of his ostracism? Rabbi Akiva, his beloved disciple, said to them: I will go, lest an unseemly person go and inform him in a callous and offensive manner, and he would thereby destroy the entire world.

Withering gaze.

What did Rabbi Akiva do? He wore black and wrapped himself in black, as an expression of mourning and pain, and sat before Rabbi Eliezer at a distance of four cubits, which is the distance that one must maintain from an ostracized individual. Rabbi Eliezer said to him: Akiva, what is different about today from other days, that you comport yourself in this manner? Rabbi Akiva said to him: My teacher, it appears to me that your colleagues are distancing themselves from you. He employed euphemism, as actually they distanced Rabbi Eliezer from them.

Some would say he lied. The exact opposite of the truth. The student learned his lessons well.

Rabbi Eliezer too, rent his garments and removed his shoes, as is the custom of an ostracized person, and he dropped from his seat and sat upon the ground.

The Gemara relates: His eyes shed tears, and as a result the entire world was afflicted: One-third of its olives were afflicted, and one-third of its wheat, and one-third of its barley. And some say that even dough kneaded in a woman’s hands spoiled. The Sages taught: There was great anger on that day, as any place that Rabbi Eliezer fixed his gaze was burned.[28]

Such is the infantile drivel that one must endure in order to examine the ‘wisdom’ of the world’s ‘holiest’ ‘sages’. 1.8 million words of it. What a legacy.

After several millennia of (supposedly) exclusive basking in the glory of ‘God’s’ Omniscient Light, there is no excuse for it:

{A}t least in one philosophical text, written sometime in the mid-thirteenth century, the anonymous Ruaḥ Ḥen, it is written: “And it is known that imagination will sometime err and Yeẓayyer [will draw] things that do not exist at all.” It is difficult to miss the negative connotation related to an act of imagination, which is prone to invent nonexistent things {..} A negative attitude towards imagination is found also in R. Abraham Abulafia’s writings, one that is equal to the imperative to “kill” it.

However, in the Kabbalistic texts we deal with here, the negative overtones have been removed and the instructions to visualize make no mention of the negative results that may be generated by imagination. This positive turn toward imagination is noteworthy for the history of Jewish mysticism.[29]

Imagine my surprise.

We will take a much closer look at Cabalist “mysteries” in future. And we will return, in detail, to the subject of rabbinic teachings on bank ‘deposits’, holding in trust, ‘clever’ redefinitions of usury, and relations with the Evil Other in the ancient Roman empire.

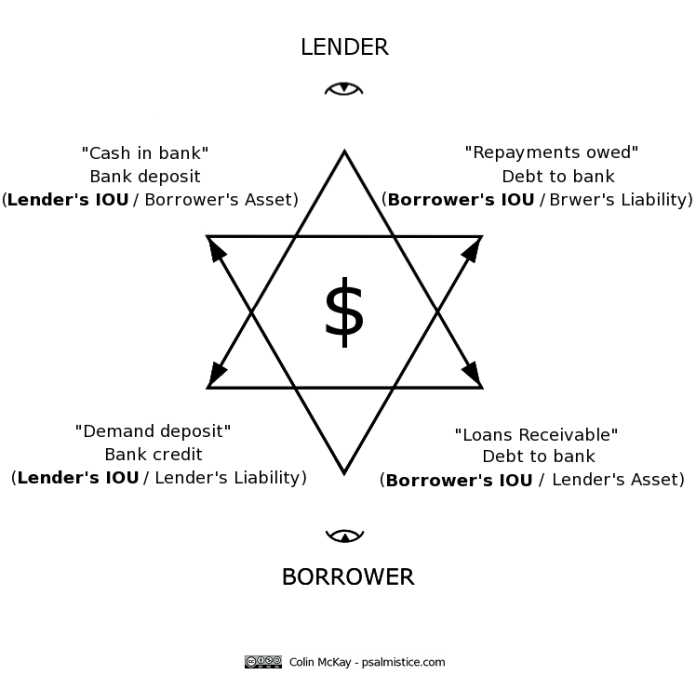

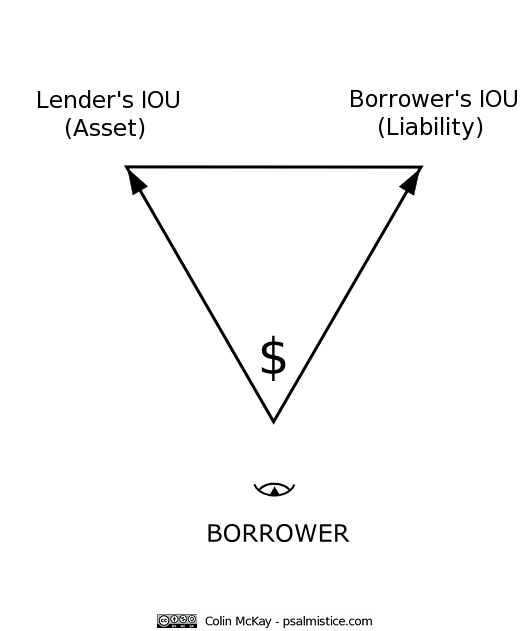

Since the time of Rome’s rise and fall, ‘imaginative’ doublethink has been embedded as the heart and soul of ‘modern’ accounting, banking, capitalism, communism, and most (if not all?) post-Renaissance economics theories.

97% of ‘money’ today ‘exists’ in the form of double-entry bookkeeping records. +1|-1, credebt entry null-ities. Used to legally counterfeit real, (formerly) sovereign, legal tender money (physical cash). This ‘money’ does not exist. It is an imaginary money, for an imaginary slavery.

Banks, debt, and money are modelled by economists as though they do not exist – which is actually true, from the higher perspective, for credebt – but the effects of their non-existence certainly do exist.

Although they are modelled as “effectively” non-existent, non-existent banks are simultaneously modelled as though they are a source of “frictions” in the economy – the exact opposite of the truth, as they are in objective reality the exclusive legal source of lubricant.

The economy – that is, the ‘forces’ of Supply and Demand, coming together to ‘negotiate’ an Exchange – are assumed to always be tending toward a state of Equilibrium; an ‘equilibrium’ supposed to be associated with Omniscient, Hedonistic, Luciferian consumers’ individual acts of perfectly-efficient ‘price discovery’. This might be the truth, if not for (inter alia) the objective reality that the operations of banks and central banks are designed to manipulate Supply and Demand volumes, and signals (‘data’), in order to deliberately create states of Dis-Equilibrium (asymmetry). Why? Because Dis-equilibrium, arising from manufactured ‘realities’ (perceptions) – such as, legally-privileged artificial shortages of credebt Supply for some, but abundance for others – is the basis for extracting (deceitful, unjust) profits. And so, in objective reality, this fundamental ‘modern’ economics axiom too, is the exact opposite of the truth.

The final word – for now – we leave to George Orwell, from his dystopian novel Nineteen Eighty-Four:

All past oligarchies have fallen from power either because they ossified or because they grew soft. Either they became stupid and arrogant, failed to adjust themselves to changing circumstances, and were overthrown, or they became liberal and cowardly, made concessions when they should have used force, and once again were overthrown. They fell, that is to say, either through consciousness or through unconsciousness. It is the achievement of the Party to have produced a system of thought in which both conditions can exist simultaneously. And upon no other intellectual basis could the dominion of the Party be made permanent. If one is to rule, and to continue ruling, one must be able to dislocate the sense of reality. For the secret of rulership is to combine a belief in one’s own infallibility with the power to learn from past mistakes.

Doublethink lies at the very heart of Ingsoc, since the essential act of the Party is to use conscious deception while retaining the firmness of purpose that goes with complete honesty. To tell deliberate lies while genuinely believing in them, to forget any fact that has become inconvenient, and then, when it becomes necessary again, to draw it back from oblivion for just so long as it is needed, to deny the existence of objective reality and all the while to take account of the reality which one denies—all this is indispensably necessary.

The official ideology abounds with contradictions even where there is no practical reason for them. [..] These contradictions are not accidental, nor do they result from ordinary hypocrisy: they are deliberate exercises in doublethink. For it is only by reconciling contradictions that power can be retained indefinitely. In no other way could the ancient cycle be broken. If human equality is to be forever averted—if the High, as we have called them, are to keep their places permanently—then the prevailing mental condition must be controlled insanity.

Crimestop means the faculty of stopping short, as though by instinct, at the threshold of any dangerous thought. It includes the power of not grasping analogies, of failing to perceive logical errors, of misunderstanding the simplest of arguments if they are inimicable to Ingsoc, and of being bored or repelled by any train of thought which is capable of leading in a heretical direction. Crimestop, in short, means protective stupidity.

It need hardly be said that the subtlest practitioners of doublethink are those who invented doublethink and know that it is a vast system of mental cheating.[30]

Let us be prepared then to excuse this frantic passion for purple, even though at the same time we are compelled to enquire, why it is that such a high value has been set upon the produce of this shell-fish, seeing that while in the dye the smell of it is offensive, and the colour itself is harsh, of a greenish hue, and strongly resembling that of the sea when in a tempestuous state?

Pliny the Elder

POSTSCRIPT: Before beginning this essay, I happened to mention my childhood “pisseth against the wall” mischief-making to my mother, who in turn mentioned it to my kindergarten teacher; her now-retired husband gives my aged mother physiotherapy. Her response? “He always was one for looking into things. I remember he used to read encyclopaedias.”

******************

REFERENCES

[1] Zgur, Andrej (2007) “The Economy of the Roman Empire in the first Two Centuries AD: An examination of market capitalism in the Roman economy”, pp. 34-35; cit. Temin, Peter (2002) “Financial Intermediation in the Early Roman Empire”, Massachusetts Institute of Technology Department of Economics Working Paper Series, Working paper 02-39 (Oct, 2002) (pdf)

[2] Zohar, Vol I, Bereshith 47a (retrieved from sacredtexts.com 7 January 2018)

[3] Foxbrunner, Dr Roman A. (1993), Habad: The Hasidism of Schneur Zalman of Lyady, New Jersey, Jason Aronson Inc, pp. 108-109

[4] Lex Oppia, The Encyclopedia of Ancient History (2016) – “The Lex Oppia, passed in 215 bce and repealed in 195 bce, prohibited women from using more than half an ounce of gold, purple-dyed clothing, or carriages except during public religious festivals. The law has become a focal point in discussions of Roman luxury and women’s rights.”

[5] Suetonius, The Twelve Caesars, Book VI: Nero; Book Six: XXX His Extravagance, A.S. Kline translation (2010). (online, retrieved 7 January 2018)

[6] ibid., Book Six: XXXII His Methods of Raising Money, (online, retrieved 7 January 2018)

[7] Bostock, John & Riley, H.T. (1855), Pliny the Elder, The Natural History, Book IX Chapter 63. (.39) (online, retrieved 7 January 2018)

[8] ibid., Book IX Chapter 62. (.38) (online, retrieved 7 January 2018)

[9] Ruscillo, Deborah (2005), Reconstructing Murex Royal Purple and Biblical Blue in the Aegean, Archaeomalacology – Molluscs in former environments of human behaviour (Oxbow Books), p.105

[10] Bostock, John & Riley, H.T. (1855), Pliny the Elder, The Natural History, Book IX Chapter 60. (online, retrieved 7 January 2018) –

It is for this colour that the fasces and the axes5 of Rome make way in the crowd; it is this that asserts the majesty of childhood;6 it is this that distinguishes the senator7 from the man of equestrian rank; by persons arrayed in this colour are prayers8 ad- dressed to propitiate the gods; on every garment9 it sheds a lustre, and in the triumphal vestment10 it is to be seen mingled with gold. Let us be prepared then to excuse this frantic passion for purple, even though at the same time we are compelled to enquire, why it is that such a high value has been set upon the produce of this shell-fish, seeing that while in the dye the smell of it is offensive, and the colour itself is harsh, of a greenish hue, and strongly resembling that of the sea when in a tempestuous state?

[11] Siloam, Wikipedia (online, retrieved 7 January 2018) cit. Smith, Stelman. The Exhaustive Dictionary of Bible Names. Bridge Logos, 2009; cit. Josephus.

[12] Elman, Yaakov, The Babylonian Talmud in Its Historical Context, p. 19, in Printing the Talmud: From Bomberg to Schottenstein, Yeshiva University Museum (online, retrieved 7 January 2018)

[13] Bava Metzia 59b:5, The William Davidson Talmud (online, retrieved 7 January 2018)

[14] Elman, Yaakov, The Babylonian Talmud in Its Historical Context, p.25, fn.26 (cit. Samuel N. C. Lieu, Manichaeism in Mesopotamia and the Roman East (Leiden: E.J. Brill, 1994), p. 25.); in Printing the Talmud: From Bomberg to Schottenstein, Yeshiva University Museum (online, retrieved 7 January 2018)

[17] Rav (amora), Wikipedia (cit. fn 1, online, retrieved 7 January 2018)

[18] Elman, Yaakov, The Babylonian Talmud in Its Historical Context, p.27, in Printing the Talmud: From Bomberg to Schottenstein, Yeshiva University Museum (online, retrieved 7 January 2018).

[20] Bava Metzia 61b, The William Davidson Talmud (online, retrieved 7 January 2018)

[21] Kaplan, Aryeh; Sepher Ha-Bahir or “The Book of Illumination”, 29-30

[22] Hendin, David (2015), Surcharge of the Money Changers, American Numismatic Society, p.2 cit. Rabbi Benjamin Yablok

[23] Rubenstein, Jeffery (1992), Purim, Liminality, and Communitas, Association For Jewish Studies Review, Vol. 17, No. 2 (Autumn 1992), pp. 247-277 –

“Frazier [The Golden Bough, 1935] noted the similarities between Purim and the Babylonian Sakaia and Zakmuk festivals. In the larger context, all these festivals are types of ‘scapegoat rituals’ often found in primitive agricultural societies. To ensure a successful harvest, these societies appointed a temporary king to impersonate the god of fertility and subsequently put him to death in the hope that he would rise again with renewed virility and power [a la the Phœnix myth, and alchemical allegory – CM].” (p.248 fn. 8).

[24] Shahak, Israel, Jewish History, Jewish Religion: The Weight of Three Thousand Years (1994, Pluto Press), Chapter 3 Orthodoxy and Interpretations (The Dispensations), p.39

[25] Faber Birren, Color, A Survey in Words and Pictures (New York, University Books, Inc.)

[26] Shahak, Israel, Jewish History, Jewish Religion: The Weight of Three Thousand Years (1994, Pluto Press), Chapter 2 Prejudice and Prevarication, p.15

[27] Shasha, David, What Is Pilpul, And Why On Earth Should I Care About It?, Huffington Post (22 May 2010), online (retrieved 7 January 2018)

[28] Bava Metzia 59b:7-8, The William Davidson Talmud (online, retrieved 7 January 2018)

[29] Idel, Moshe (2015), Visualization of Colors, I: David ben Yehudah he-Hasid’s Kabbalistic Diagram, Ars Judaica 2015, p.42

[30] Orwell, George (1949), Nineteen Eighty-Four, Centennial Edition (2003), First Plume Printing