Doublethink means the power of holding two contradictory beliefs in one’s mind simultaneously, and accepting both of them.

These contradictions are not accidental, nor do they result from ordinary hypocrisy: they are deliberate exercises in doublethink. For it is only by reconciling contradictions that power can be retained indefinitely. In no other way could the ancient cycle be broken. If human equality is to be forever averted—if the High, as we have called them, are to keep their places permanently—then the prevailing mental condition must be controlled insanity.

George Orwell, Nineteen Eighty-Four

Oh the irony.

Or perhaps rather, the karma.

From the birthplace of el modo vinegia (“the Venetian Method”) of Double Entry Bookkeeping, and the modern banking Usurocracy that it spawned more than half a millennium ago, comes academic confirmation of the “outright false accounting” and “double nature” of bank ‘money’.

Exactly as explained in my 2016 essay, Dishonourable Debt: Why Borrowers Are Not Legally Bound To Repay Bank Loans.

Professor of Accounting Massimo Costa, along with former international financial markets professor and current World Bank and IMF advisor Biagio Bossone, have confirmed that so-called “money of account” created by Double Entry Bookkeeping is a “systematically concealed” tool for extracting “seigniorage rent” from the labour of the human race.

In academic jargon, it is “a structural element of subtraction of net real resources from the economy, with potentially deflationary effects on profits and/or wages, distributional consequences, and frictions between capital and labor.”

In other words, the global banking system is an enormous parasite, and its parasitic method is fraudulent.

Their article relates to the heart of my essays (eg, here, here, here, here, here) on the ancient, alchemical philosophistry – the word ‘magic’ with numbers added – on which the ‘modern’ banking system is built.

According to Costa and Bossone (Monies (old and new) through the lens of modern accounting), banks are “hybrid institutions”, and customer deposits are “‘hybrid’ liabilities”:

More generally, absent adverse economic or market contingencies inducing depositors to convert deposits into cash, the liabilities represented by deposits only partly constitute debt liabilities of the issuing bank, which as such require [central bank] reserve coverage. The remaining part of the liabilities is a source of income for the issuing bank – income that derives from the bank’s power to create money. In accounting terms, to the extent that this income is undistributed, it is equivalent to equity.

This double nature of demand deposits is stochastic in as much as, at issuance, every deposit unit can be either debt (if, with a certain probability, the issuing bank receives requests for cash conversion or interbank settlement) or equity (with complementary probability).

This is exactly as I explained in Dishonourable Debt:

Despite the fact that they claim to have loaned us all this money, thanks to the magical paradox at the heart of double-entry accounting, they also claim, simultaneously, precisely the opposite to be true — that we have actually loaned all that money to them.

[..]

Believe it or not, there is an explanation—albeit a perverse, morally abhorrent and unconscionable explanation—for this, and in turn, for how the creeping global preparations to legally steal the “deposit” assets of bank customers (refer above diagram) is able to be “justified” by the banks, the financial and political authorities, and the unelected, BIS-funded, Goldman Sachs alumni-chaired FSB.

At the heart of the matter is the ever-present paradox of perspective inherent in the Babylonian Duality Principle on which double-entry accounting is based.

Banks are able to create new (so-called) ‘money’ ex nihilo through the loan origination process. As this is recorded using double-entry accounting, every new loan results in a new Asset and a new Liability on the banks’ balance sheet records.

However, because banks act both as new loan (thus, new ‘money’) originators and as financial intermediaries, there is no way of disaggregating the Liability side of any bank’s balance sheet in order to clearly distinguish between those “deposits” that have arisen in consequence of that bank’s own lending (so-called), and those “deposits” that have arisen in consequence of that bank’s intermediation (i.e., ‘transfers’ of ‘money’ from one customer account to another customer account at the same bank, or, from the customer accounts of other financial institutions to customers of the bank).

Whether or not any particular unit of any particular “deposit” amount could truthfully be defined as ‘money’ loaned to the bank by a customer, or, loaned by the bank to a customer, is dependent on knowing with complete certainty how and when each and every unit came to be recorded in the customer account. The only customer account for which such certainty is possible, is a customer account created by the bank at the moment of first originating a loan, and, before any new entry for even one single fractional unit of the denominated currency has been either added to, or subtracted from that customer account.

There is one further exception – an account established for one of the bankers’ favourite clients—arms dealers, drug cartels, mafioso, and other criminal organisations such as the CIA—at the first moment of the client handing over real legal tender cash notes at the bank to open the account.

In any event, since even a ‘transfer’ of ‘money’ from one bank to another still has the same ultimate origin—an out-of-nothing creation of an electronic record of a mutual exchange of promises to pay—then from a whole-of-banking-system perspective it really doesn’t matter; all so-called ‘money’ on ‘deposit’ is simultaneously owned by the customers, and by the banks.

In other words, the global Usurocracy’s rent-extracting ‘money’ system is based on the arbitrary, subjective, relativist ‘logic’ and philosophistry of Cabala, or what George Orwell called doublethink – “the power of holding two contradictory beliefs in one’s mind simultaneously, and accepting both of them.”

Doublethink is related to, but differs from, hypocrisy and neutrality. Also related is cognitive dissonance, in which contradictory beliefs cause conflict in one’s mind. Doublethink is notable due to a lack of cognitive dissonance—thus the person is completely unaware of any conflict or contradiction.

Thanks to 503 years of “progressive” regulatory capture – amounting to nothing less than a thinly-concealed regime of state-sponsored Usurocracy – it is the banks’ exclusive privilege to ‘earn’ compounding usury on all the self-annihilating, +1|-1 Double Entry ‘money’ units that they create out of nothing:

Owing to double nature of commercial bank money, a relevant share of the deposits that banks report in the balance sheet as ‘debt toward clients’ generates revenues that are very much similar to the seigniorage rent extracted by the state through the issuance of state money (coins, banknotes, and central bank reserves).

Costa and Bossone confirm that it is precisely this “double nature” of bank ‘money’ that enables banks to hide the reality of their extracting “seigniorage rent” from the labour of the human race. How?

By not recording the value of their imaginary accounting ‘money’ – supposedly “equivalent” to, or, in more honest words, a counterfeit of, real physical government legal tender cash notes and coins – on their Income Statement:

Under current accounting practices, seigniorage is largely underappreciated, it is systematically concealed, and is not allocated to the income statement (where it naturally belongs), while it is recorded on the balance sheet under debt liabilities, thus originating outright false accounting.

As I extensively evidenced, this fraudulent system is actively aided and abetted by the “secretive”, tax haven-registered, “private” corporations of the international accounting standard-setters; a fact also confirmed – tacitly – by Costa and Bossone:

The stochastic double nature of bank money is consistent with the principles of general accounting as defined in the Conceptual Framework of Financial Reporting, which sets out the concepts underpinning the International Financial Reporting Standards (IFRS). In light of these standards, demand deposits are a hybrid instrument – partly debt and partly revenue. The debt part relates to the share of deposits that will (likely) be converted into cash or reserves, while the revenue part relates to the share of deposits that will (likely) never be converted into cash or reserves. This share of deposits is a source of revenue.

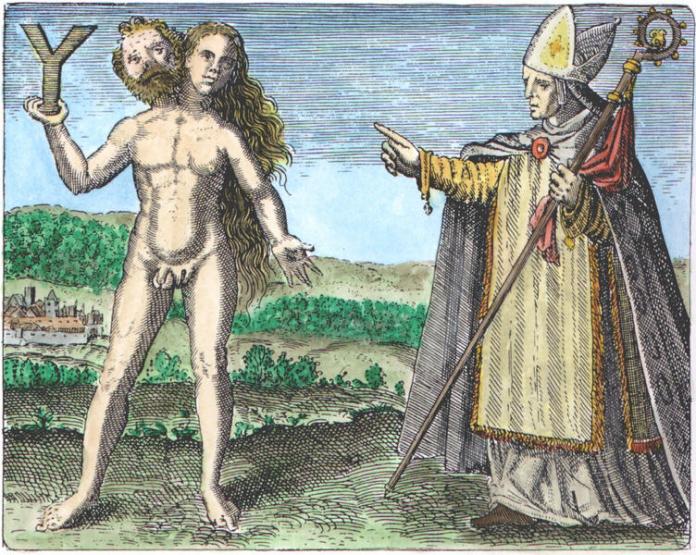

The Mercurial Rebis: A Crowned and Bat-winged Hermaphrodite, Buch der heiligen Dreifaltigkeit, late 14th Century (Munich MS, Bayerische Staatsbibliothek, CGM. 598). Source: Adam McLean, alchemywebsite.com

Albertus Magnus (c. 1200-1280), from Michael Maier, Symbola aurea mensae, 1617. © Adam McLean 1997-2017 (alchemywebsite.com). Used with permission.

What Costa and Bossone (conveniently?) neglect to mention is that the share of so-called ‘deposits’ that “will (likely) never be converted into cash or reserves”, and that is thus “a source of revenue,” is around 97%.

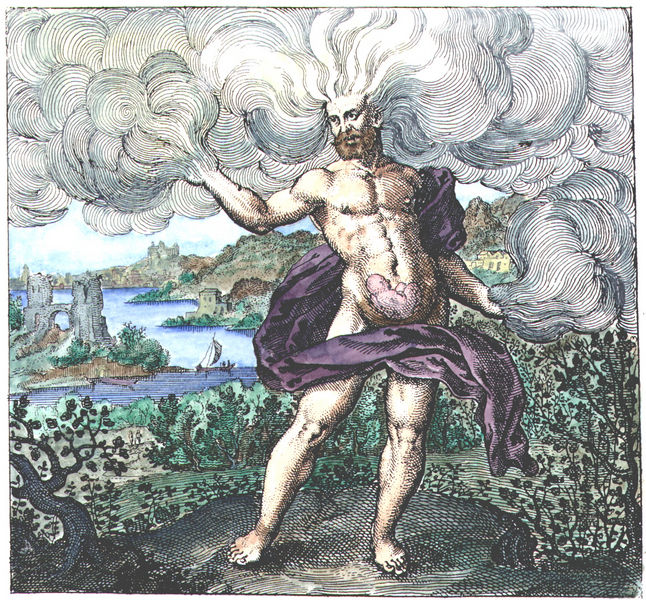

Michael Maier, Atalanta Fugiens: Emblemata Nova de Secretis Naturae Chymica, 1618. © Adam McLean 1997-2017 (alchemywebsite.com). Used with permission.

Rather like the banks conveniently neglecting to mention the same 97% on their Income Statement.

Apparently it is sufficient to describe what is in reality the vast majority as merely “a relevant share”.

In “Dishonourable Debt” we saw that effective July 1, 2009 – in the middle of the global banking liquidity crisis known as the “GFC” – the Financial Accounting Standards Board (FASB) introduced Accounting Standards Codification (ASC) §305 Cash and Cash Equivalents. This new standard effectively sanctioned – and further concealed – the banks’ misleading and deceptive conduct in renting their electronic records of promises to pay physical cash under the guise of so-called ‘money’. As I observed:

The FASB has ex post facto codified that banks may consider bank ‘credits’ (a record of a promise to pay cash) as actually being “cash” for accounting purposes; that the customers’ perspective of bank ‘credits’ “shall” be that those ‘credits’ are (literal physical) “cash”, and, that they are not amounts owed to them by the bank…

Pure Orwellian doublethink.

This should help us to understand the real reason why, for several decades, there has been an accelerating drive by the international banking system to ‘normalise’ numerous forms of electronic banking and ‘money’ – including crypto currencies – and more recently, to actively discourage and even to incrementally (“Boiling Frog” strategy) restrict or outright ban the use of physical cash.

Contrary to all propaganda, this carrots-and-sticks drive towards a global economy reliant on pure abstraction, rather than real physical currency, has nothing to do with improving “convenience” for the public, or “efficiency” in the banking system, much less with “fighting crime” or “the black market”.

Real physical cash – State legal tender – is perhaps the weakest link in the Usurocracy’s “golden chain” of Double Entry ‘magic’ enslaving the human race.

Real physical cash is what the Usurocracy is counterfeiting, using +1|-1 Double Entry nullities, and then “systematically” concealing by not reporting their counterfeit ‘cash’ on their Income Statements.

Once physical cash is eliminated, the promises-to-pay ‘money’ system will be fully “unfettered” and “independent” from the real, tangible world. It will exist solely in the abstract, “imaginary”, ‘magic’ paradox-riddled, counterfeit world (pun intended) of Double Entry Bookkeeping controlled by the Usurocracy.

“The bookkeeper can be king if the public can be kept ignorant of the methodology of the bookkeeping.”

Do read and share this outstanding resource compiled by Urunu: The Cashless Society.

A friend of mine who worked as a currency trader told me that “money doesn’t exist” when I expressed concern that the amount of money passing through his hands could have a deleterious effect on him. I imagined that it was a sort of invisible energy. I intuited that he was correct and knew he was not just jiving me and decided to understand this riddle as abstract knowledge and to form it into words. As to the latter you have been very helpful, thanks. I think that ,running a confidence racket of such proportions ,the perpetrators must have a lot of muscle behind them and this is the real barrier to sorting it out.

As I have posted before, these two verses fit the Banker parasites for me –

.

THE GENERAL EPISTLE OF BARNABAS

.

From The Lost Books of the Bible and the Forgotten Books of Eden, Collins-World Publishers

.

CHAPTER 9

.

4. Neither, says he, will you eat the eagle, nor the hawk, nor the kite, nor the crow; that is, you must not keep company with the kind of men who do not know how to get themselves food by their labor and sweat, but injuriously steal the things of others and watch how to lay snares for them, when at the same time they appear to live in perfect innocence.

.

5. So these birds alone seek not food for themselves, but sitting idle seek how they may eat the flesh others have provided, being destructive through their wickedness.

Urunu: The Cashless Society

http://www.urunu.com/blog/2018-06-04-cashless-society

this article is gone, cannot find it archived

do you have a link

It’s been republished here: https://samisdat.info/blog/the-cashless-society