“I would like to continue with an examination of Time. From the moment we enter this life we are in the flow of it. We measure it and we mark it. But we cannot defy it. We cannot even speed it up or, slow it down. Or can we?”

– Eisenheim, The Illusionist

Time. The Fourth Dimension. The Universal Agent.

Imagine having the power to control Time. To manipulate Time. To become its master. Instead of feeling like a slave to Time, imagine what you might do, if you had the power to make Time work for you?

Men have always dreamed of possessing this power. In 15th century Italy, the discovery of mysterious ancient documents in Byzantium finally made it possible.

Today, we often speak of the value of “our time”. We speak of “spending time”, and “buying time”. But in truth, it is not “our” time at all.

Throughout the world, our Time is controlled, manipulated and directed, by ‘Masters of the Universe’. Men who are adepts in these ancient secrets, and have the power to make “our” Time work for them.

They are the bookkeepers. The men who keep score. And just as it is said of the game of golf that “a good scorer can always beat a good player”, so it is with the mystical, magical art of double-entry bookkeeping.

“For every debit there must be a credit, and for every credit there must be a debit” – Alas! How few consider that if this must be the case, the rule to go by, nothing is more easy than to make a set of books wear the appearance of correctness, which at the same time is full of errors, or of false entries, made on purpose to deceive!1

When the “Father of the Renaissance”, a humanist scholar, priest, and astrologer by the name of Marsilio Ficino translated the Corpus Hermeticum from Greek into Latin, he could not have known that his labour would, in time, condemn most of humanity to slave labour for the Lords of Time.

Bust of Ficino by Andrea Ferrucci in Florence Cathedral (Source: Wikipedia)

Ficino’s lifelong patron was Cosimo de Medici, scion of the famous Italian merchant banking dynasty, and ruler of the Florentine Republic. His circle of friends included the greatest philosophers, mathematicians, and elite movers-and-shakers in the Western world. They now had in their hands the ancient secrets of Hermes Trismegistus, the “Thrice-Greatest”.

Hermes Trismegistus, floor mosaic in the Cathedral of Siena (Source: Wikipedia)

Starting at the Medici-sponsored Platonic Academy headed by Ficino, the rediscovered Hermetic secret knowledge would light the imaginative fires of the principal scholars, philosophers, and financiers of the Renaissance — also known as the “Hermetic Reformation”2. It would influence the mind of a monk, magician, mathematician, the Father of Accounting and the man who wrote the seminal book on double-entry bookkeeping, Fra Luca Bartolomeo de Pacioli, the “constant companion of Leonardo da Vinci”3. And in a grand syncretism with Neo-Platonism and Jewish Kabbalah, conjured up and expounded by fellow Renaissance men such as Pico della Mirandola (900 Theses), Johannes Reuchlin (De Arte Cabbalistica), and Heinrich Cornelius Agrippa (De Occulta Philosophia Libri Tres), it would spread throughout the western world, deeply embedded in commerce and banking, the arts and sciences, social philosophy, ethics and morality. It would change the course of human history (bold and italicised emphasis added):

Our modern urge to measure everything dates back to the late Middle Ages when a “radical change of perception” took place in which mathematics, Venetian bookkeeping, and Luca Pacioli played a key role. Historian Alfred W. Crosby explains this “radical change”:

‘In practical terms the new approach was simply this: reduce what you are trying to think about to the minimum required by its definition; visualise it on paper, or at least in your mind … and divide it, either in fact or in imagination, into equal quanta. Then you can measure it, that is, count the quanta.’

And once you can measure something, then you have a quantitative or numerical representation of your subject which you can manipulate and experiment with, no matter how great its errors or omissions. Such data can acquire an apparent independence from its human creators and, when fed into a twenty-first century computer model, an authority that appears irrefutable.4

Portrait of Luca Pacioli, traditionally attributed to Jacopo de’ Barbari, 1495 (Source: Wikipedia)

Now, it is well worth our time to pause for a moment in our journey through past time, to consider the identity of Hermes Trismegistus. Today, he is considered to be a syncretism of the Greek god Hermes, and the Egyptian god Thoth. The Greeks considered Hermes to be the god of boundaries and transitions – in particular, the transition to the after-life. He was also the god of commerce, travel, the patron of thieves and orators, and a cunning trickster who outwits other gods for his own satisfaction. The Greeks equated him with the Egyptian god Thoth, who shared similar attributes. Thoth was seen by the Egyptians as the god who maintained the universe, the mediator in disputes between good and evil. He was the god of equilibrium, who unified or balanced the opposites. Importantly, in both of their respective cultures, Hermes and Thoth were the gods of writing, and magic.

The more astute reader, and in particular, the reader who has a grasp of the Duality Principle of double-entry bookkeeping — “for every credit there must be an equal debit” — may already be seeing a little light dawning in a corner of their mind.

Ficino and his influential friends at the Medicean court were to discover in the Corpus Hermeticum and in Kabbalah Ma’asit (“practical Kabbalah”) the secrets to controlling Time, the Universal Agent. At the heart of Hermetic teachings was the idea that man could influence or even control the forces of nature. To do so, one needed to master the “Three Parts of the Wisdom of the Whole Universe”. One of these parts, along with Astrology and Theurgy, was the magical art of Alchemy. Similarly, at the heart of Kabbalistic theurgy was the idea that man could magically invoke the creative or Life force — using esoteric knowledge of divine language and writing — for personal advantage in this world.

As with double-entry bookkeeping — and similarly, the dark art of keeping two sets of books — the magic of Alchemy involves a dual aspect or dual nature. In its esoteric (inner) doctrine, it is the work of spiritual purification; a transformation of common impure man, into pure and perfect Man. In its exoteric (outer) doctrine, it is the notion that man can transform common “impure” metals into pure gold, through the discovery and mastery of the “Universal Solvent”.

The magic of Hermeticism, with its emphasis on practical experimentation to discover and control the forces of nature, would have a powerful effect on the greatest scientific minds (such as Isaac Newton) for centuries to come. At the same time, its intrinsic get-rich-quick appeal would pose a constant attraction for over-indebted kings and princes — and for too-big-to-fail international bankers such as the Medici, whose compound interest-bearing loans the princes of Europe could not repay without borrowing even more.

The Emerald Tablet, a key text of Western Alchemy, in a 17th-century edition (Source: Wikipedia)

Some four hundred years later, a great revival of spiritualism and the magick arts swept over Europe during the late nineteenth through early twentieth centuries. It is from this time, in the writings of adepts such as the famous occultists Aleister Crowley and Eliphas Lévi, that we can see clearly stated the most fundamental principles of Hermetic-Kabbalistic magick.

As we will see, they are precisely the same principles that form the basic rules of double-entry bookkeeping. Hermetic-Kabbalistic magick has been carried down from the Hermetic Reformation of the 15th century to our time, deeply embedded at the very core of all economic and social life; in commerce, economic theory, the fundamentals of capitalism, and banking.

The Hermetic-Kabbalistic magick principle of double perception is embedded at the core of the money system itself. In the very act of ex nihilo (“out of nothing”) creation of “our” money in the form of loans — using nothing more “real” than electronic double-entry bookkeeping — bankers enjoy the power of creator gods, employing “divine” magick principles in writing and language to harness the force of Time, transforming it into wealth for themselves.

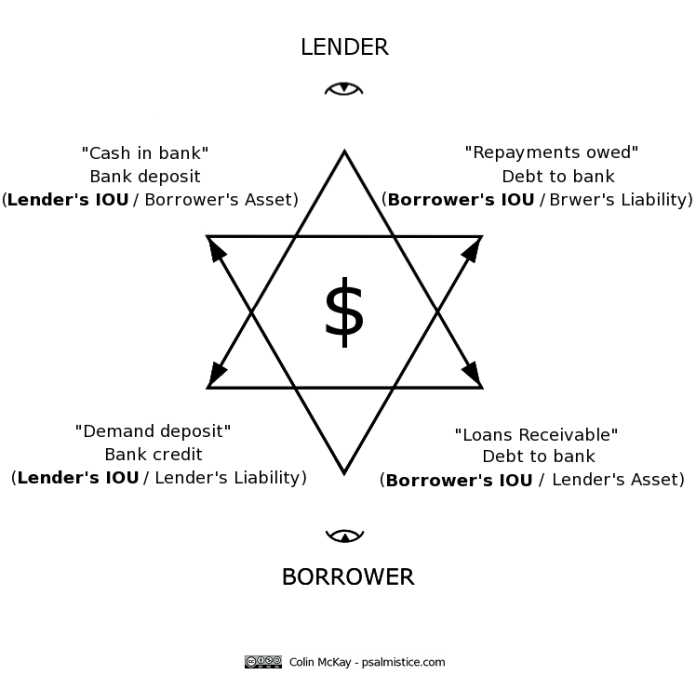

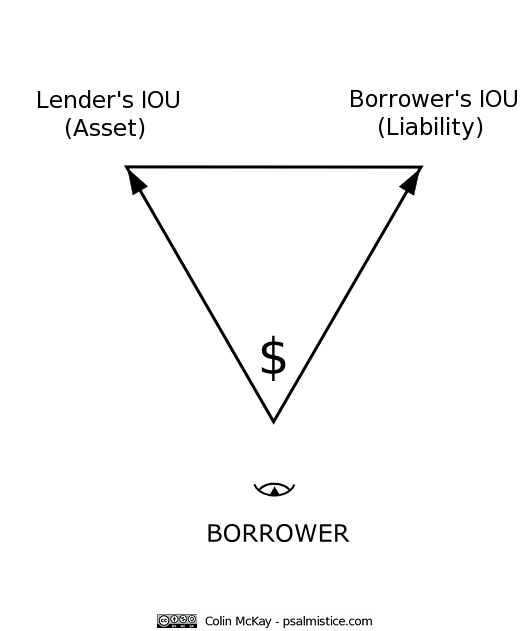

“Money” created by bankers is simply the symbolic, written expression of this double perception. Each Dollar, Euro, or Pound created as a new loan magically appears (to the borrower) as both a debt (Liability) that must be repaid plus interest to the bank, and simultaneously, a credit (Asset) that the borrower can spend.

At the same time, to the bank that very same Dollar, Euro, or Pound magically appears as both an Asset (money that must be repaid by the borrower), and, a Liability too, because the bank must make it available to the borrower to spend.

This is the embodiment of the Kabbalistic concept of achdut hashvaah (“Unity of Opposites”) — (bold emphasis added):

The coincidence of opposites that characterizes God, humanity and the world can be approximately understood by the simultaneous adoption of two points of view. As put by the founder of the Chabad movement, Schneur Zalman of Lyadi (1745-1813):

(Looking) upwards from below, as it appears to eyes of flesh, the tangible world seems to be Yesh and a thing, while spirituality, which is above, is an aspect of Ayin (nothingness). (But looking) downwards from above the world is an aspect of Ayin, and everything which is linked downwards and descends lower and lower is more and more Ayin and is considered as naught truly as nothing and null.5

When viewed from this Kabbalistic “higher” logic perspective, the mathematical expression “-1 = +1” is actually true; an object and its exact opposite are seen to be one and the same thing. A single unit of “money” is both credit and debit, liability and asset; it just depends on whose perspective it is seen from. But all things balance themselves out, when viewed from the hidden “All-Seeing Eye” perspective of the divine nothingness or Ein Sof. Each number is created from the same central number (“0”); the space “0” between -1 and +1 is exactly “1” from either side, and so each cancels out the other:

When it arose within Ein-sof (the Infinite) to weave Yesh (Something) from its Ayin (Nothing), Ein-sof performed an act of Tzimtzum, contracting and concealing itself from a point, thereby forming a central, metaphysical void. It is in this void that the Primordial Man, Adam Kadmon, and all the countless Worlds (Olamot) emerge.6

In the cryptic, mystical language of Hermetic-Kabbalistic magick, Aleister Crowley, the man once dubbed “The Most Wicked Man In The World”, explains the fundamentals of Magick In Theory And Practice (bold emphasis added):

…the object of any magick ceremony is to unite the Macrocosm and the Microcosm.

It is as in optics; the angles of incidence and reflection are equal. You must get your Macrocosm and Microcosm exactly balanced, vertically and horizontally, or the images will not coincide.

This equilibrium is affirmed by the magician in arranging the Temple. Nothing must be lop-sided. If you have anything in the North, you must put something equal and opposite to it in the South. The importance of this is so great, and the truth of it so obvious, that no one with the most mediocre capacity for magick can tolerate any unbalanced object for a moment. His instinct instantly revolts. …

…the arrangement of the weapons of the altar must be such that they “look” balanced…

…And however little he move to the right, let him balance it by an equivalent movement to the left; or if forwards, backwards; and let him correct each idea by implying the contradictory contained therein.

…let him show the basis of that Stability to be constant change, just as the stability of a molecule is secured by the momentum of the swift atoms contained in it.

In this way let every idea go forth as a triangle on the base of two opposites, making an apex transcending their contradiction in a higher harmony.

It is not safe to use any thought in Magick, unless that thought has been thus equilibrated and destroyed.7

In his magnum opus Transcendental Magic, French occultist Eliphas Lévi explains that:

There exists in Nature a force which is immeasurably more powerful than steam, and a single man, who is able to adapt and direct it, might change thereby the face of the whole world. This force was known to the ancients; it consists in a Universal Agent having equilibrium for its supreme law, while its direction is concerned immediately with the Great Arcanum of Transcendental Magic. … This agent… is precisely that which the adepts of the Middle Ages denominated the First Matter of the Great Work.8

Now the ancients, observing that equilibrium is the universal law in physics, and is consequent on the apparent opposition of two forces, argued from physical to metaphysical equilibrium, and maintained that in God, that is, in the First Living and Active Cause, there must be recognized two properties which are necessary to each other—stability and motion, necessity and liberty, rational order and volitional autonomy, justice and love, whence also severity and mercy. And these two attributes were personified, so to speak, by the kabalistic Jews under the names of GEBURAH and CHESED.9

Lévi says that to gain control over the “Great Magical Agent”, one must learn how to use the alchemical formula of opposites, “Solve et Coagula” (SOLVE, to dissolve, to project, to move; and COAGULA, to coagulate, to concentrate, to fix):

The Great Magical Agent, by us termed the Astral Light, …this occult, unique and indubitable force, is the key of all empire, the secret of all power. … To know how to make use of this Agent is to be the trustee of God’s own power; all real, effective Magic, all occult force is there, and its demonstration is the sole end of all genuine books of science. To have control over the Great Magical Agent there are two operations necessary — to concentrate and project, or, in other words, to fix and to move.10

Who can fail to see here, hidden in plain sight, the distilled essence, the Philosopher’s Stone, the whole alchemical formulation of double-entry bookkeeping?

The adept takes every single “common” transaction, and on entering it into his books, he first dissolves it (SOLVE) into a pair of opposites (debit entry and credit entry).

When it comes time to determine his Profits — and in turn, his total wealth or Capital — he “coagulates” (COAGULA) all of the entries in each of two columns (DR and CR) into a single number.

This then, is the apex of the triangle, the “higher harmony” of the “base of two opposites”, “transcending their contradiction”.

Seal of Solomon; front page of Eliphas Lévi’s ‘Transcendental Magic, its Doctrine and Ritual’ (Source: Wikipedia)

Eliphas Lévi tells us plainly that the purpose of the Great Work is to gain control over one’s future; that is to say, to gain control of Time itself:

The Great Work is, before all things, the creation of man by himself, that is to say, the full and entire conquest of his faculties and his future; it is especially the perfect emancipation of his will, assuring him… full power over the Universal Magical Agent.11

For the man who is greedy for gain, who sees financial wealth as the secret to a long and happy life, the possession of money is the means to attain “the full and entire conquest of his…future”. He can transform himself from a pauper into a prince — “the creation of man by himself” — and become a “self-made man”.

How so?

Money is the means of controlling Time. By lending his money at compound interest, the skillful adept increases his wealth, without risking his health through manual labour. His little pile of wealth (“capital”) grows inexorably, compounding into an ever larger pile over time. Just as in Eisenheim’s great illusion of the Orange Tree, the “seed” which was taken by dividing a single orange into two equal parts, grows at a speed which defies Time, “producing” even more golden fruit – fruit that the magician assures us is “quite real”.

This wondrous power is all thanks to the magic of what has been called “the greatest mathematical discovery of all time” and “the most powerful force in the universe” — compound interest.

But in a classic example of circular reasoning, the alchemical wizard’s “right” to charge compound interest is all thanks to a cunning rhetorical device (remember, Hermes was the god of oratory) — the so-called “Time value” of money.

Money, wrote [Luca Pacioli’s mentor, Leon Battista] Alberti in the 1430s, is “the root of all things”: “with money one can have a town house or a villa; and all the trades and craftsmen will toil like servants for the man who has money. He who has none goes without everything, and money is required for every purpose.” As historian Fernand Braudel argues, something new enters European consciousness in Alberti’s writing – along with his celebration of money went thriftiness and a concern with the value of time…12

This clever sophistry of the “Time value of money” has its origin in one of the greatest moral arguments of all time; whether the charging of interest on money (usury) is right, or wrong.

For over 1,000 years the Christian West officially prohibited the practice of charging interest on money (usury). But in the 15th century, the advocates for usury found themselves equipped with a new box of rhetorical and symbolic tricks with which to convince their audience. The syncretism of Neo-Platonic, Kabbalistic, and Hermetic philosophies in the Renaissance (“rebirth” in French) resulted in the resurrection of ancient Greco-Roman paganism. With it came an individualistic, “Me”-centred rather than “God”-centred worldview, with all-pervading emphasis on rationalism, and numerical calculation. In particular, the calculation of profit (bold emphasis added):

[German economist Werner Sombart] says that by enabling a numerical, monetary (and hence, in his view, “rational”) calculation of profit, double-entry bookkeeping provided the basis on which commerce could be seen as a process of acquisition: as an unending, systematic pursuit of profit.13

Like Sombart, [Max] Weber argues that double entry is significant because it makes possible an abstract measure of income and expenses – and therefore enables the calculation of profit, the key component of capitalistic business practice.14

The economist Joseph Schumpeter (1883-1950) also traces the development of capitalism back to double-entry bookkeeping. … Schumpeter says that capitalism adds a new edge to rationality by “exalting the monetary unit – not itself a creation of capitalism – into a unit of account. That is to say, capitalist practice turns the unit of account into a tool of rational cost-profit calculations, of which the towering monument is double-entry bookkeeping.” In his view, double entry’s “cost-profit calculus” drives capitalist enterprise – and then spreads throughout the whole culture: “And thus defined and quantified for the economic sector, this type of logic or attitude or method then starts upon its conqueror’s career subjugating – rationalizing – man’s tools and philosophies, his medical practice, his picture of the cosmos, his outlook on life, everything in fact including his concepts of beauty and justice and his spiritual ambitions.” For Schumpeter, capitalism “generates a formal spirit of critique where the good, the true and the beautiful no longer are honoured; only the useful remains – and that is determined solely by the critical spirit of the accountant’s cost-benefit calculation”.15

Double-entry bookkeeping would then, as now, serve the purpose not only of helping the merchant calculate his profits. It would enable the merchant to “prove” that his profit-making was legitimate; that is to say, in context of the times, that he had not been practicing usury in violation of the Church’s official prohibition (bold emphasis added):

[Luca] Pacioli advises merchants to incorporate explicit signs of Christianity into their books as a way of legitimising their profit-seeking activities. The use of double entry itself was like the Catholic confession: if a merchant confessed – or accounted for – all his worldly activities before God, then perhaps his sins would be absolved.16

This notion of ‘good’ bookkeeping was soon extended to the point that the use of double entry was seen to confer moral legitimacy on a merchant’s work. As Pacioli had, Hugh Oldcastle encouraged merchants to use their account books as a space in which to invoke God. He wrote in 1588: “it behoveth him [the merchant] first in all his workes and business to call to minde the name of God in all such writings, or in any other reckonings, that he shall beginne.” The first cashbook of the Bank of England, established in 1694, opens with ‘Laus Deo‘ – ‘Praise God’. As we saw with the merchants of Prato and with Pacioli, such appeals to God were a common feature of the earliest double-entry books and in some parts of Europe continued until the eighteenth century: through the exactitude of their earthly accounting, merchants hoped to gain divine approval in God’s heavenly accounts.17

If you are a businessman concerned with the morality of making a profit, then keeping the fullest possible set of accounts is a bit like confessing your sins.

Even if you are doing something morally suspect, at least you are making a clean breast of it.18

Indeed exactly because accountancy looks like a dry, value-free activity, it can be used as a kind of moral laundry.

When the Nazis stole the personal property of Europe’s Jews, Himmler insisted that all the looted property be meticulously accounted for.

By enforcing stringent accounting, he argued that “in carrying out this most difficult of tasks… we have suffered no harm to our inner being, our soul, our character.” Theft was transformed into book-

keeping.19

For an enormously successful usurer like Cosimo de Medici, who had the rare quality for a banker of suffering from a guilty conscience20, the matter of having one’s sins absolved had a profound importance. At that time, the only way to be absolved of the mortal sin of usury, and so be assured of a transition to Heaven in the after-life (hello Hermes/Thoth), was by making full restitution of all one’s ill-gotten gains. This meant, of course, that you could not pass on your wealth to your heirs; if you failed to make restitution before death, then in order to set you free from purgatory, your heirs would have to make restitution of all your usurious gains on your behalf:

Giovanni di Bicci de Medici, founder of the Medici Bank and Cosimo de Medici’s father … died intestate because in making out a will “he would have denounced himself as a usurer and might have caused considerable trouble for his heirs.” This practice had become a Medici family tradition, which Cosimo, Giovanni’s son would continue.21

Cosimo de Medici, Portrait by Bronzino (Source: Wikipedia)

The popularisation of double-entry bookkeeping in the Medici’s time offered another profoundly important benefit. It gave the merchant a way to “rationally” justify all of his “costs” — including the “costs” he perceives himself to have suffered, in extending (lending) “credit” to customers.

This would prove crucial in context of the historical argument on usury. Then, as now, those who argued in favour of usury have claimed that a man who lends his money to another has a moral right to be compensated for a wholly imaginary expense — the “opportunity cost” of his not being able to use the money he loaned out, to earn more money in some other way.

The “logic” of this argument for charging interest rests on an arrogant presumption — that the lender is certain of earning a “return” in that “other way”, and therefore, he must certainly be suffering a “cost” of lost “opportunity” to “earn”, if he lends his money out instead.

The unstated notion here, of course, is that, one way or another, the owner of money must always receive even more money. Gimme gimme gimme, more more moar!

It is on the foundation of this sophistry of an imaginary “opportunity cost” suffered by the money-lender — and “proven” to be real simply by writing it into his double-entry accounting books — that an even greater sophistry is built — that of the Time Value of Money.

In a 1991 paper on accounting and rhetoric, Bruce G. Carruthers and Wendy Nelson Espeland argue that the symbolic language of double-entry bookkeeping is as significant as its technical capabilities … They argue that a double-entry account is not just a piece of neutral information, but also an “account” or story; that accounting is not merely a technical practice, but also a means of framing a set of business transactions with a rhetorical purpose.22

Accounting’s use of numbers gives it an air of scientific rectitude and certitude, and yet fundamental uncertainties lurk at its heart. Indeed, accounting is as subjective and partial as the art of storytelling, the other meaning of the word “account”.23

The illusion – for that is precisely what it is – that money possesses within itself an innate characteristic called “Time value”, is quite simply the greatest public deception of all time. When the arcane teachings of Hermes Trismegistus were infused and codified in el modo vinegia (“the Venetian method”) of double-entry bookkeeping in the 15th century, the twin magic arts of writing and sophistry were woven together to form the material of the magician’s cloak, and the curtain behind which the Wizards of Oz have hidden ever since.24

As Jakob Burckhardt, and following him, Frederich Nietzsche, said of the Italian Renaissance, it was a time of sophistic. The sophistic character of the Renaissance is apparent not simply from its rhetorical perspectives and practices, but in its use of the first sophists as well.25

In an essay published in 1985, the historian James Aho linked double-entry bookkeeping to the ancient art of rhetoric, the rules used to make persuasive arguments perfected by the Roman lawyer and orator Cicero (an art, incidentally, which Aristotle says sprang from a property dispute). According to this argument, medieval merchants used double-entry bookkeeping as a rhetorical tool of capitalist propaganda, to persuade their ‘audience’ that their business was honest, morally sound and its profit-making justified.

Why would bookkeeping need to persuade? Because, says Aho, it was used to defend these businesses against the Church’s ban on usury. The rhetoric of a well-kept ledger argued for the honesty of a business and the legitimacy of its profits, as this advice from 1683 makes clear: “If [the merchant] be fortunate and acquire much, [double entry] directs him the way to Imploy it to the best advantage, if he be unfortunate it satisfies the world of his just dealing, and is the fairest and best Apologie of his Innocence and honesty to the World.”26

Today, we are born into a world where the “logic” that money possesses a Time Value seems self-evident. The idea is so deeply embedded in our individual and collective consciousness, it has become part of our common language. Everyone knows that “Time is Money”.

This belief that money has an intrinsic Time Value is, however, nothing more than a spectacularly sly, self-serving example of self-interested swindlers successfully selling a self-referential, “self-creating” sophistry. For over 500 years, its purpose has been to persuade us all that money will certainly earn more money over time; and therefore, money possesses the innate power to earn more money over time; and therefore, the Lords of Time must have the right to charge interest for the use of money lent out, as compensation for their “lost opportunity” (ie, Time) to “earn” more money from their money’s innate power to earn more money.

This first half of the “Time Value of money” circular flow of illogical reasoning has come to be universally accepted, largely because so few pause to consider the unstated second half of the circle, which goes like this: and therefore, the Lords of Time must also have the right to pay interest (if they wish) to people who deposit money with them for “safe-keeping” (storage), as compensation for their “lost opportunity” to “earn” more money from money’s innate power to earn more money — err, say what now?! — (and whose deposits the Lords of Time can also lend out and charge interest for); and therefore, since it is now firmly established that money deposited with the Lords of Time will earn interest over time, this proves that money will certainly earn more money over time, and therefore money obviously possesses the innate power to earn more money over Time, etc etc, ad infinitum.

In its definition of the Time Value of Money, Investopedia unwittingly lets the cat out of the bag, highlighting this circular reasoning which lies (pun intended) at the dark heart of the grand mystical numberland of finance (bold and italicised emphasis added):

DEFINITION OF ‘TIME VALUE OF MONEY – TVM’

The idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. This core principle of finance holds that, provided money can earn interest, any amount of money is worth more the sooner it is received.

Everyone knows that money deposited in a savings account will earn interest. Because of this universal fact, we would prefer to receive money today rather than the same amount in the future.27

Clearly then, the circular logic of the supposed Time Value of Money fails, if ever the “universal fact” that “money deposited in a savings account will earn interest” fails.

Like, err, now.

At this present time, so-called “ZIRP” (Zero Interest Rate Policy) and even “NIRP” (Negative Interest Rate Policy) is spreading all over the moribund economies of the Western world. We now receive zero interest on money deposited in a savings account. Not only that, in an increasing number of Western countries, the Lords of Time are now charging interest (ie, paying negative interest) on money deposited in a savings account. Yes, that’s right … if not now, then very soon, they will charge you interest for “holding” money on deposit in the “safe-keeping” of their bank.

Why are they doing this? As with so many magician’s tricks, the key to successfully pulling off the illusion, is movement. In the sideshow hustler’s game of Thimblerig or Three Shells and a Pea28, the faster the hustler moves his hands, the more difficult it is to see that he has moved or even pocketed the pea.

“The Conjurer,” painted by Hieronymus Bosch (between 1496 – 1520). The painting accurately displays a performer doing the cups and balls routine, which has been practiced since Egyptian times. The shell game does have some origins in this old trick. The real trick of this painting is the pickpocket who is working for the conjurer. The pickpocket is robbing the spectator who is bent over. (Source: Wikipedia)

In the great alchemical trick of Hermes the Thrice-Greatest and his Latter-Day Saints, this vital movement is called “Flow”, or the “Velocity of the Circulation of Money”. So long as the flow of money in the economy is fast enough, no one notices that the game is actually rigged. That is, no one notices that there is insufficient money in the system to pay interest.

This policy of zero (or even negative) interest rates on bank deposits, is all about trying to speed up the flow of money in the economy. The Lords of Time are hoping that this policy will encourage people to spend (“Flow”), not save (“Stock-pile”) money.

Why? Because the only way for the Lords of Time to keep on “earning” compound interest on the intergalactic levels of debt that they have lent to the world, is to make the “money” flow fast enough.

The real truth of the Money Illusion is this: If everyone had to settle their debts at the same time, there is always far more money owed, than there is money to pay with. The game only seems to work fairly and honestly if we only look under one shell at any time, and, if we believe the hustler’s claim that the missing pea really is just hiding under one of the other shells all the time.

In a recent article in Forbes titled “The Principal And Interest On Debt Myth”,29 a modern day mathematician and globally renowned academic economist set out to prove to the now-growing crowd of questioning (and in some cases, hostile) finger-pointers, that we should all just “Move along now, there’s nothing to see here”.

That is to say, he challenged the view that “because banks lend principal, but insist that principal and interest be paid by the debtor, the money supply has to grow continuously to make this possible”.

His proof?

A simple model of a “simplest possible financial system” … based on double-entry bookkeeping:

Alas, the accounting fraud-riddled history of double-entry bookkeeping ever since its Western popularisation by Fra Luca Pacioli (and more importantly, by his powerful patrons in the world of money-lending), strongly suggests that a reliance on the “logic” of double entry to “prove” anything with regard to banking, money, debt, and compounding interest, is tantamount to using the casino’s own roulette wheel in an attempt to “prove” that the game of roulette is not rigged in favour of the house.

Or, to return to our shell game analogy, it is tantamount to relying on a sideshow hustler’s own sleight of hand skills to “prove” that the pea you couldn’t see really was under one of those three shells all the time.

It all works fine (for the hustler), whilst ever the “flow” of the hustler’s hands is fast enough to fool the common man. But if the flow is slowed – in economic terms, by a growing “loss of confidence” in the game, resulting in too many people saving or “hoarding” money (Stability) rather than spending it (Movement) — suddenly the hustle begins to be exposed. At a slower rate of “flow”, it becomes much more easy to see that the hustler has been pocketing the pea all along.

Happily, the economist writing in Forbes did admit that the money-lenders’ money-shuffling game only works “so long as those flows are large enough”:

He also admitted that his simple model does not reflect the real world, which “is far more complicated”:

He also admitted that it is possible to enter different values for the limited set of parameters he chose for his simple model, that would make his conclusion (that interest can be paid without increasing the money supply) “untenable”:

But arguably his most important admission of all was not included in his Forbes article. Rather, it is on his Twitter account that we find his admission, that it is mathematically impossible for everyone to pay their debts at the same time:

In his zeal to disprove the claims of a growing crowd of questioning onlookers who are pointing out that the monetary alchemists’ shell game is rigged, the good professor has fallen afoul of the error of oversimplification. A simple double-entry bookkeeping model, of a “simplest possible financial system”, having a limited set of parameters, that obviously does not include all the parameters of the real world’s financial system, but that does include a number of invalid assumptions (eg, the notion that banks are “consumers”, who spend all their earnings back into the “flow” of the national economy); a model that does not reflect the real world “which is far more complicated”, is a model that is quite obviously too simple, and does not prove (or disprove) anything at all.

Jane Gleeson-White, author of Double Entry: How The Merchants of Venice Shaped Modern Finance, relates an interesting and relevant anecdote regarding Fra Luca Pacioli, the acclaimed father of accounting. On 11 August 1508, Pacioli gave an introductory public lecture at the church of San Bartolomeo near the Rialto Bridge in Venice (bold emphasis added):

Some five hundred people came to hear the celebrated mathematician speak … The famous Venetian printer Aldus Manutius was there and may have brought along Erasmus, who was staying with him near the Rialto while supervising the printing of his translation of Euripedes and a collection of ancient proverbs.

Intriguingly, after leaving Italy in 1509 Erasmus wrote his famous satire, In Praise of Folly, in which he mocks scientists who use maths to bamboozle their audience. His description of these boffins rather accurately parodies the methods used by Luca Pacioli in his talk on Euclid: “When they especially disdain the vulgar crowd is when they bring out their triangles, quadrangles, circles, and mathematical pictures of the sort, lay one upon the other, intertwine them into a maze, then deploy some letters as if in line of battle, and presently do it over in reverse order – and all to involve the uninitiated in darkness.” In his book, Erasmus set out to deflate the pretensions of anyone who claimed special knowledge or importance, whether they were philosophers, merchants or clerics.30

In his Praise of Folly .. he calls Mercury the inventor of tricks or of conjuring (“Quos nos ludos exhibet furtis ac praestigiis Hermes?”—“What entertainments does Hermes show us, with his tricks and sleight-of-hand?”)31

Bernard Lietaer is a former central banker, fund manager, and co-designer of the European Currency Unit (precursor to the Euro), who was named “the world’s top currency trader” by Businessweek in 1992. Today, Lietaer is a currency system reformer with almost 40 years active experience in the field. In Rethinking Money, he uses the brilliant analogy of the game of musical chairs, to help explain how “our” alchemical money system really works.

His analogy helps to illuminate this fundamental point – that it is only when the music (money “flow”) slows (“economic slowdown”) or stops (“credit crunch”), and people get nervous (“economic con-fidence”) and start looking for a chair to sit on, that we discover there never was enough chairs (“money”) for everyone:

Essentially, to pay back interest on a loan requires using someone else’s principal. In other words, not creating the money to pay interest is the device used to generate the scarcity necessary for a bank-debt monetary system to function. It forces people to compete with each other for money that was never created, and it penalizes them with bankruptcy should they not succeed. When a bank checks a customer’s creditworthiness, it is really verifying his or her ability to compete successfully against the other players – that is to say, assessing the customer’s ability to extract from others the money that is required to reimburse the interest payment. One is obliged in the current monetary system to incur debt and compete with others in order to perform exchanges and pay the resulting interest to the banks and lenders.32

Although new loans are being created, the interest on the principal is not. Nowhere in the system is this additional money created. This gives rise to scarcity, which, in turn, creates competition to acquire the extra money to cover the loans’ interest. This magic, where one person’s loan becomes another’s deposit, and whereby when you pay interest you are using someone else’s principal, is really monetary alchemy. This monetary alchemy is one of the esoteric secrets of the monetary system.33

A key point to keep in mind is that this entire money-creation process hinges on loans. If all debts were repaid, money would simply disappear, because the entire process of money creation would reverse itself. Reimbursing all loans would automatically use up all the deposits.34

When a banker checks a customer’s credit score, it is to assess how successful or aggressive that individual or business will be in contending with others to obtain funds that are not created in sufficiency to pay back the interest on the loan.35

In a manner of speaking, it’s like a game of musical chairs in that there are never enough seats for everyone. Someone will end up getting squeezed out. There isn’t enough money to pay the interest on all the loans, just like the missing chair. Both are highly competitive games. In the money game, however, the stakes are elevated, as it means grappling with certain poverty or, worse still, having to declare bankruptcy.36

The real brilliance of Lietaer’s musical chairs analogy is that it helps the “common” man and woman to easily visualise, and understand, the alchemists’ critical need for monetary “motion” as opposed to “stability”, in order to conjure an apparent economic “equilibrium” of “constant change” (ie, constant economic “growth”) moving through time. It is, we now see, an illusory “equilibrium”, built on the ancient magic of sophistry and numbers, and contrived to “produce” compound “yields” for the Wizards of Oz hiding behind the curtain:

…let him show the basis of that Stability to be constant change, just as the stability of a molecule is secured by the momentum of the swift atoms contained in it.

In this way let every idea go forth as a triangle on the base of two opposites, making an apex transcending their contradiction in a higher harmony.

It is not safe to use any thought in Magick, unless that thought has been thus equilibrated and destroyed.37

Unlike these present-day Lords of Time and their legions of high priests all preaching the obscure doctrines of Hermetic-Kabbalistic economic theology, Lietaer is speaking an everyday, “common” language — of “common” imagery and symbols — that we can easily understand. Most important to notice though, is that his clear and simple language is a result of his motivation. He seeks not to obfuscate but to elucidate.

In a telling passage of John Maynard Keynes: Vol 2 The Economist As Saviour 1920-1937, Keynes’ biographer Robert Skidelsky informs us that (bold and italicised emphasis added):

In Keynes’s view capitalism’s driving force is a vice which he called “love of money” … in the General Theory “the propensity to hoard” or “liquidity preference” plays a vital part in the mechanics of an economy’s rundown, once something has happened to make investment less attractive. And this links up with Keynes’s sense that, at some level too deep to be captured by mathematics, “love of money” as an end, not a means, is at the root of the world’s economic problem.38

Nearly two thousand years earlier, Jesus of Nazareth pointed to the same thing, in debunking the money-lenders’ illusion (delusion) that “‘Time’ (‘God’) is ‘Money'”:

No one can serve two masters; for either he will hate the one and love the other, or else he will be loyal to the one and despise the other. You cannot serve God and mammon [money].39

*******

UPDATE 2/2/2016

“To know and not to know, to be conscious of complete truthfulness while telling carefully constructed lies, to hold simultaneously two opinions which cancelled out, knowing them to be contradictory and believing in them both, to use logic against logic, to repudiate morality while laying claim to it (…) To tell deliberate lies while genuinely believing in them, to forget any fact that has become inconvenient, and then, when it becomes necessary again, to draw it back from oblivion for just as long as it is needed, to deny the existence of objective reality.”

— George Orwell, defining “doublethink” in his book 1984

“Today, many nations are revising their moral values and ethical norms, eroding ethnic traditions and differences between peoples and cultures. Society is now required not only to recognise everyone’s right to the freedom of consciousness, political views and privacy, but also to accept without question the equality of good and evil, strange as it seems, concepts that are opposite in meaning. This destruction of traditional values from above not only leads to negative consequences for society, but is also essentially anti-democratic, since it is carried out on the basis of abstract, speculative ideas, contrary to the will of the majority, which does not accept the changes occurring or the proposed revision of values.”

— Vladimir Putin, Presidential Address to the Federal Assembly, December 12, 2013

UPDATE: 10/2/2016

Added Faivre quotation, footnote 31.

UPDATE: 2/3/2016

Corrected first three diagrams consistent with DE balance sheet rule (Assets – left, Liabilities – right).

UPDATE: 3/26/2016

Added video clip “It’s called an economy” – see Once Upon A Time – An Allegory For Usury On Primetime American TV

*******

[1] Edward Thomas Jones, Jones’ English System of Book-Keeping by Single or Double Entry, 1796

[2] James D. Heiser, Prisci Theologi and the Hermetic Reformation in the Fifteenth Century, 2011

[3] Jane Gleeson-White, Double Entry: How The Merchants of Venice Created Modern Finance, 2013

[4] ibid.

[5] Sanford L. Drob, The Doctrine of Coincidentia Oppositorum in Jewish Mysticism, 2000

[6] Sanford L. Drob, The Theosophical Kabbalah, 2001

[7] Aleister Crowley, Magick in Theory and Practice, Book IV, Part III, Chapter VIII; Of Equilibrium: and of the General and Particular Method of Preparation of the Furniture of the Temple and the Instruments of Art

[8] Eliphas Lévi, Transcendental Magic, Its Doctrine and Ritual, 1896

[9] ibid.

[10] ibid.

[11] ibid.

[12] Jane Gleeson-White, Double Entry: How The Merchants of Venice Created Modern Finance, 2013

[13] ibid.

[14] ibid.

[15] ibid.

[16] ibid.

[17] ibid.

[18] Jolyon Jenkins, How Men In Grey Suits Changed The World, 2010 – http://news.bbc.co.uk/2/hi/uk_news/magazine/8552220.stm

[19] ibid.

[20] E. Michael Jones, Barren Metal: A History of Capitalism As The Conflict Between Labor And Usury, 2014

[21] ibid.

[22] Jane Gleeson-White, Double Entry: How The Merchants of Venice Created Modern Finance, 2013

[23] ibid.

[24] Bill Still, The Wonderful Wizard of Oz: A Monetary Reformer’s Brief Symbol Glossary – http://www.themoneymasters.com/the-wonderful-wizard-of-oz-a-monetary-reformers-brief-symbol-glossary/

[25] Richard Marback, Plato’s Dream of Sophistry, 1999

[26] Jane Gleeson-White, Double Entry: How The Merchants of Venice Created Modern Finance, 2013

[27] Investopedia, Time Value of Money – http://www.investopedia.com/terms/t/timevalueofmoney.asp

[28] Wikipedia, Shell Game – http://en.wikipedia.org/wiki/Shell_game

[29] Steve Keen, The Principal And Interest On Debt Myth, Forbes, 2015 – http://www.forbes.com/sites/stevekeen/2015/03/30/the-principal-and-interest-on-debt-myth-2/

[30] Jane Gleeson-White, Double Entry: How The Merchants of Venice Created Modern Finance, 2013

[31] Antoine Faivre, Eternal Hermes: From Greek God to Alchemical Magus, 1995

[32] Bernard Lietaer and Jacquie Dunne, Rethinking Money, 2013

[33] ibid.

[34] ibid.

[35] ibid.

[36] ibid.

[37] Aleister Crowley, Magick in Theory and Practice, Book IV, Part III, Chapter VIII; Of Equilibrium: and of the General and Particular Method of Preparation of the Furniture of the Temple and the Instruments of Art

[38] Robert Skidelsky, John Maynard Keynes: Vol. 2, The Economist As Saviour 1920-1937, 1994

[39] Matthew 6:24, The Sermon on the Mount, New King James Version